How’s that for a click bait title? Well it is true at least from a monthly payment point of view. One of the biggest hurdles that condominiums and to a lesser extent townhouses have to overcome is the HOA dues each month. Lenders require that the borrower qualify not only for the PITI (principle, interest, taxes, insurance) payment, but also the HOA dues. This means that the borrower has to qualify for much more than just the purchase price. When interest rates are low the HOA dues become a relatively high portion of that payment, but as they rise the cost of the monthly payment rises not the HOA dues, thus the HOA dues become a lesser percentage of the whole.

Here is an example. Back a few years ago we saw mortgage rates dip into the 2’s for awhile. But let’s just use 4% as an example. We shall suppose a borrower is looking at a condo that is listed at $500,000 and 4% mortgage is available with 100k down, HOA dues are $500 a month, taxes $2500 a year, no mortgage insurance. The PITI payment would be roughly $2185 plus $500 for HOA making the total monthly burden $2685 per month. The borrower must qualify for this amount. This buyer is only buying a $500,000 property in this scenario but qualifies to buy $554,000 house without an HOA fee. Generally traditional houses lack an HOA but have higher property taxes and homeowners insurance cost, but that is still a big difference. Now fast forward to the present day with rates now tickling 8% and things look much different. The PITI payment plus the HOA fees on the condo, all else being equal is now $3643 per month. This translates to purchasing power of $535,000 on a property with no HOA. Again, bear in mind that taxes and insurance are less on condos than traditional property because the HOA is paying the taxes on the land and carries structural hazard insurance so that the condo owner only has to cover the inside of the unit against hazards. Now most HOAs cover some of the utility expenses as well with water and garbage being fairly common. Some type one construction towers have heating and cooling covered by the HOA as well. In these scenarios with interest rates above 7%, the condo can reach near parity with a traditional house when utility expenses are calculated in.

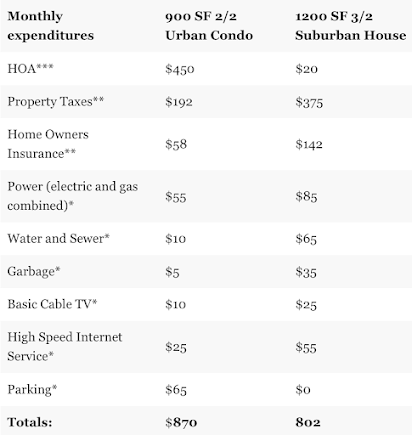

There are already many people that want a less bothersome ownership experience free of yard work, and general exterior maintenance. Now that rates are climbing, condos actually start to look like a value in the marketplace even with the HOA dues. A typical small suburban single family house in Vancouver has property taxes at $4500 annually versus a comparable priced condo at just $2000. Look at the chart below asterisks reference footnotes explaining the composite average:

- * The composite average takes into account that many HOA fees include either a discounted rate or no charge at all for these services. In the case of parking some units have deeded spaces others requires a fee the fee is typically at least $100 in the urban core. The composite average merges these in to one.

- ** Property Taxes and Home Owners Insurance on condos is severely reduced as the condo owner only pays taxes on the interiors space, the HOA pays for the land taxes. Similar for insurance in that HOA carries hazard insurance for the structure, home owner carries hazard and theft for the interior.

- *** Although many single family homes do not have an HOA, most built in the last 20 years do. Typically dues are much less expensive as the HOA has mostly enforcement duties versus a condo HOA that has actual structural maintenance and heavy services to do. Composite average includes a lot of homes without an HOA at all, thus lowering the average for SFH HOA dues.

No comments:

Post a Comment