Rod's outlook for real estate in 2018: Here in the Portland Metro in a word, "healthy." I do not foresee a massive spike in pricing or the crazy multiple offer bidding wars 10% above asking like we saw in the first half of this year. That tends to be sort of exciting but it is not sustainable and it is terrible for the buyers trying to get a house before they close on the one they just sold.

I see a market that should remain in the favor of sellers under roughly 115% of median value. From 115% to the upper middle bracket of 200% of median I see the strong possibility of neutral market conditions. Above that 200% of median, locally above $600k may even slide into a slight buyers market. I don't see soften prices, just very modest appreciation in the high end and average to slightly less than average appreciation in the low to middle price ranges.

This is a healthy condition because home values that rise in double figures for more than a few years leads to hard crashes as that greatly outstrips the wage growth. A healthy market with values appreciated in the 3-5% range is sustainable long term and when things get tight on incomes the market will get a soft landing.

The new tax law recently passed by congress and signed by the President, will increase the standard deduction for a married couple to $24,000 per year. The ability to deduct state and local taxes has been severely cut back. For entry level home buyers the ability to "write off" mortgage interest may not be a viable option. You see, a $300,000 mortgage at 4% will have about $13,000 in deductible interest in the first year and it will decline each year as the balance is reduced. Most people cannot come up with another $9,000 in deductions to reach the point of beating the standard deduction, so itemizing may not make sense anymore. This is a huge benefit to renters as they will now gain a massive increase in deduction where as home owners will either save a little or see no gain in benefit.

According to the politicians the idea was to eliminate the need for average Americans to fill out complex tax forms, pay accounting fees to do it for them, or buy software to help them. I suppose this is a good thing, but not everyone likes this flavor of taxation.

Homeowners should talk to a tax pro to see how the changes for 2018 will affect them. Self employed people and others with large company and business expenses will likely continue to do taxes they way they always have. But W-2 wage earners may see a nice simplification to the annual annoyance that is filing tax returns.

Those with larger mortgages and or higher than average deductible expenses will not likely benefit from the higher standard deduction but all taxpayers will benefit from the lower tax brackets. Overall I remain cautiously optimistic about the plan, congress does have a way of screwing things up though, so we shall see :)

Happy New Year! I'll be back in 2018.

Friday, December 29, 2017

Tuesday, December 26, 2017

Tax Bill is now Law, get packin'

So now that the new tax system will be implemented all those ready to retire or already retired just got a big new reason to look at Washington State. Especially Californians and Oregonians with that ENORMOUS state income tax down there.

That's all I got this time, really. Happy Holidays see you next year :)

That's all I got this time, really. Happy Holidays see you next year :)

Friday, December 22, 2017

Last Chance for Tax Prep

Did you buy a house this year? Did you do a major refinance of you personal residence this year? If you did either you should meet with your tax guy before the end of the year. Home mortgage interest can play a significant role in you tax burden and you may have had a big enough change to itemize deductions where you previously did not. This means lots of things to deduct against you tax bill. It is already the 22nd of December and you better get crackin'

Once a taxpayer has reached the point where he or she can itemize deductions on the 1040 form, there are many legitimate deductible expenses that can be taken. It may even be worth while to make a few legitimate business purchases based on what you professional tax guy says.

The new tax law passed by the Congress earlier this week may change your ability to itemize deductions so this year could be the year you want to make deductible purchases. The new law will increase the standard deduction by roughly double. This means many people that are itemizing now, may not need to starting next year. Your tax guy can explain the details, but I suggest you find out before the end of the year.

Many homeowners benefit from itemizing deductions and if you own a home with a mortgage you should seek professional tax help to make sure you are not paying MORE than you fair share to Uncle Sam. Let's face it, the IRS is more like a crazy uncle when you think about it. Our elected representatives are not exactly spending YOUR money wisely, so keep as much as you can fairly under the law. Talk to a pro, you only got 4 business days left!

Happy Holidays to all!

Once a taxpayer has reached the point where he or she can itemize deductions on the 1040 form, there are many legitimate deductible expenses that can be taken. It may even be worth while to make a few legitimate business purchases based on what you professional tax guy says.

The new tax law passed by the Congress earlier this week may change your ability to itemize deductions so this year could be the year you want to make deductible purchases. The new law will increase the standard deduction by roughly double. This means many people that are itemizing now, may not need to starting next year. Your tax guy can explain the details, but I suggest you find out before the end of the year.

Many homeowners benefit from itemizing deductions and if you own a home with a mortgage you should seek professional tax help to make sure you are not paying MORE than you fair share to Uncle Sam. Let's face it, the IRS is more like a crazy uncle when you think about it. Our elected representatives are not exactly spending YOUR money wisely, so keep as much as you can fairly under the law. Talk to a pro, you only got 4 business days left!

Happy Holidays to all!

Friday, December 15, 2017

Slight Softening could be Golden Opportunity

Prices are stable in the local market with modest appreciation in values. I am seeing a little bit of a bump in inventory which is a much needed softening of the heavy seller's market we battled last spring.

Buyers that were frustrated over the summer with multiple offers and aggressive competition for property in what was a very tight inventory situation, may find that things tempered a bit. It seems like the number of buyers has lightened a touch and a modest gain in sellers is leveling the market into a healthy near neutral condition that just slightly favors sellers.

This is more evident in the upper price ranges but even in the sub-median market I see openings for buyers. Interest rates are nudging up and that can lower the buying power of buyers. This current moderation in the market coupled with still very low mortgage rates could be a golden opportunity to strike a deal for a house.

The classic fence sitters are faced with an opportunity that may not be around by summer. With rates on government backed mortgages still in the low 4s, and a slight flattening in appreciation, the time is now for buyers. Buyers should remember that historically speaking, any rate under 6% is a "low" rate. We have been under 6% for a very long time so some people may be under the delusion that 5% is a "high" rate.

I have written on this very blog about the dangers of waiting for a better price in a rising rate market. Rate will almost always hurt the bottom line more than price. Most analysts are predicting a modest gain in values for 2018 and rates are trending up which amounts to the classic "double jeopardy" scenario.

Get off that fence!

Buyers that were frustrated over the summer with multiple offers and aggressive competition for property in what was a very tight inventory situation, may find that things tempered a bit. It seems like the number of buyers has lightened a touch and a modest gain in sellers is leveling the market into a healthy near neutral condition that just slightly favors sellers.

This is more evident in the upper price ranges but even in the sub-median market I see openings for buyers. Interest rates are nudging up and that can lower the buying power of buyers. This current moderation in the market coupled with still very low mortgage rates could be a golden opportunity to strike a deal for a house.

The classic fence sitters are faced with an opportunity that may not be around by summer. With rates on government backed mortgages still in the low 4s, and a slight flattening in appreciation, the time is now for buyers. Buyers should remember that historically speaking, any rate under 6% is a "low" rate. We have been under 6% for a very long time so some people may be under the delusion that 5% is a "high" rate.

I have written on this very blog about the dangers of waiting for a better price in a rising rate market. Rate will almost always hurt the bottom line more than price. Most analysts are predicting a modest gain in values for 2018 and rates are trending up which amounts to the classic "double jeopardy" scenario.

Get off that fence!

Friday, December 8, 2017

originally posted 10-21-2016

|

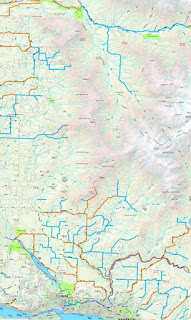

| Snow on ground at 850 feet, no snow in Vancouver on this day |

Here in Clark County we have many neighborhoods scattered throughout the Cascade foothills. Some subdivisions have houses bumping right up against 2000 feet above sea level. In general once you get up above 1000 feet, winter weather is more... well... wintry. Sellers need to be aware that selling property in the foothills up higher than a 1000 feet is not going to produce many showings during the winter months. It is important to maximize the showings by following good showing tactics. Keep the home warm and bright and keep snow clear of the walkways and driveway. But capitalize on winter themes. Often buyers looking up in the mountains during the winter want to have real winter weather. Keep that fireplace stoked and feel free to build a snowman!

Down in the valleys of Vancouver and Portland snowfall is far less common than rain. Locally Vancouver averages about 6 inches a year at Pearson field. But averages are deceiving. There are years that have no snow at all and others that have heaping amounts. Meanwhile, up in the mountains things are more defined. Above a thousand feet it is not a case of if it snows, but rather, how much snow will there be.

Buyers should keep this in mind as well. Many people are looking for a rural home on some acreage. As one moves east generally things start to climb in elevation. Clark County's entire eastern flank is the Cascades with elevations rising up to about 4000 feet before spilling into Skamania County.

When seeking a home up at elevations in the 1000-2000 range which is about as high as you'll find a home in the county, there are a few things to consider. Most higher elevations above 2000 feet are part of the Washington State DNR or the Gifford Pinchot National Forest which do not contain developed neighborhoods.

|

| East County Snow Routes |

Since those monster events are so rare, the county keeps a modest amount of equipment for winter snow removal. Usually most snow events are well handled by the county crews. Those 'snowzilla' events however, will leave the roads snow covered and dangerous. The primary and secondary routes are important if home buyers do not wish to traverse hard-packed, snow-covered roads on a regular basis. Clark County has a published chart showing the snow removal routes for rural areas.

Consider carefully properties that are more than a quarter to half a mile off one of these snow removal routes as travel can be perilous in the mountains when it snows. Remember it may be raining in Vancouver and snowing up in the foothills.

Additional families with school age children should consider school district rules for snow. Generally a wide spread snow event with even modest amounts of snow can trigger a school closure. For mountain dwellers however there will be many days in which schools remain open because it's raining in the valleys and snowing up high. On those days, school buses often run special "snow routes". These will keep buses off the steep terrain and require that parents get the kids to the snow route bus stop on their own. These are things to consider when buying a home above 1000 feet.

It should be noted that most of the time areas between 800-1200 feet don't get huge amounts of snow all at once unless it's during one of the every five years 'snowzilla' event. What happens up around 800-1200 feet is that there is simply more snowy days. 1-2 inches in Vancouver might equate to 3-5 inches at 1000 feet. But there will be 3 to 4 times as many snowy days and as the elevation rises so rises the number of times per year snow falls. Also up above 1000 feet the snow tends to stick around longer than it does down in the valleys.

I would like to note that none of Clark County's incorporated urban areas exceed 800 feet in elevation. The high spot is probably Prune Hill in Camas at just under 800 feet. It is the rural country areas in the Cascade foothills that can be up close to 2000 feet. Buyers worried about snow but looking at traditional suburban or urban neighborhoods need not worry about heavy snow outside of the rare events.

Friday, December 1, 2017

Agents and Clients Need to be Ready For the Routine

Sounds like a , "No Duh" kind of thing, right? Well, I don't know, because it never ceases to amaze me how often routine delays are taken like apocalyptic symptoms of the inevitable end of the transaction in a fiery ball of doom. And sometimes the panic is coming from an agent.

Real estate deals have one thing in common 99% of time, they will have a delay or some mild drama before they are closed. The sun will rise and set at the end of day, and real estate transactions will have someone, somewhere, somehow, need more time for an integral part of the deal. So we know it's coming, we are told in advance it will, yet... EEEEK!! The appraisal is late! Of course it is, it's nearly always late. OH NO! The lender needs some additional documentation! Yes the lender usually does.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

A few things that buyers and sellers can do to protect themselves from these potential issues.

Real estate deals have one thing in common 99% of time, they will have a delay or some mild drama before they are closed. The sun will rise and set at the end of day, and real estate transactions will have someone, somewhere, somehow, need more time for an integral part of the deal. So we know it's coming, we are told in advance it will, yet... EEEEK!! The appraisal is late! Of course it is, it's nearly always late. OH NO! The lender needs some additional documentation! Yes the lender usually does.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.A few things that buyers and sellers can do to protect themselves from these potential issues.

- Do not try to perfectly time the closing of your current home and the closing of the new one. That is a 75% fail rate. Get the buyer of your current home to offer you an optional rent back for at least a week after expected close date.

- Buyer's currently renting; don't give up your rental for at least two weeks after you "expect" to close. This will cost you half a month's rent but it will give you a nice cushion for unexpected delays in closing and will give you time to move without the pressure of the "gotta get out today" syndrome.

- Buyers getting a mortgage; when the loan officer asks for paperwork or other documents no matter how mundane, do it, do it right NOW!

- Buyer's using a loan; Do not move big chunks of money around between accounts. Park your cash in the account you gave the lender and leave it there until you get the keys to the new house.

- Buyer's getting a mortgage; do not borrow money or buy any big ticket items on credit and don't even apply for credit till you get your new house keys. Yes even when the clerk at Macy's says, "if you apply for a Macy's card you get 25% off this whole purchase..." Make like Nancy Reagan and just say NO!

Most real estate transactions will have bumps along the way, don't panic, it's got a 95% chance of being fine. Sometimes deal crushing bad news comes and that is just the way the ball bounces in life; but most of the time it is gonna be OK, so relax, take a deep breath, because you will be closed in no time.

Subscribe to:

Posts (Atom)