Rod's outlook for real estate in 2018: Here in the Portland Metro in a word, "healthy." I do not foresee a massive spike in pricing or the crazy multiple offer bidding wars 10% above asking like we saw in the first half of this year. That tends to be sort of exciting but it is not sustainable and it is terrible for the buyers trying to get a house before they close on the one they just sold.

I see a market that should remain in the favor of sellers under roughly 115% of median value. From 115% to the upper middle bracket of 200% of median I see the strong possibility of neutral market conditions. Above that 200% of median, locally above $600k may even slide into a slight buyers market. I don't see soften prices, just very modest appreciation in the high end and average to slightly less than average appreciation in the low to middle price ranges.

This is a healthy condition because home values that rise in double figures for more than a few years leads to hard crashes as that greatly outstrips the wage growth. A healthy market with values appreciated in the 3-5% range is sustainable long term and when things get tight on incomes the market will get a soft landing.

The new tax law recently passed by congress and signed by the President, will increase the standard deduction for a married couple to $24,000 per year. The ability to deduct state and local taxes has been severely cut back. For entry level home buyers the ability to "write off" mortgage interest may not be a viable option. You see, a $300,000 mortgage at 4% will have about $13,000 in deductible interest in the first year and it will decline each year as the balance is reduced. Most people cannot come up with another $9,000 in deductions to reach the point of beating the standard deduction, so itemizing may not make sense anymore. This is a huge benefit to renters as they will now gain a massive increase in deduction where as home owners will either save a little or see no gain in benefit.

According to the politicians the idea was to eliminate the need for average Americans to fill out complex tax forms, pay accounting fees to do it for them, or buy software to help them. I suppose this is a good thing, but not everyone likes this flavor of taxation.

Homeowners should talk to a tax pro to see how the changes for 2018 will affect them. Self employed people and others with large company and business expenses will likely continue to do taxes they way they always have. But W-2 wage earners may see a nice simplification to the annual annoyance that is filing tax returns.

Those with larger mortgages and or higher than average deductible expenses will not likely benefit from the higher standard deduction but all taxpayers will benefit from the lower tax brackets. Overall I remain cautiously optimistic about the plan, congress does have a way of screwing things up though, so we shall see :)

Happy New Year! I'll be back in 2018.

Friday, December 29, 2017

Tuesday, December 26, 2017

Tax Bill is now Law, get packin'

So now that the new tax system will be implemented all those ready to retire or already retired just got a big new reason to look at Washington State. Especially Californians and Oregonians with that ENORMOUS state income tax down there.

That's all I got this time, really. Happy Holidays see you next year :)

That's all I got this time, really. Happy Holidays see you next year :)

Friday, December 22, 2017

Last Chance for Tax Prep

Did you buy a house this year? Did you do a major refinance of you personal residence this year? If you did either you should meet with your tax guy before the end of the year. Home mortgage interest can play a significant role in you tax burden and you may have had a big enough change to itemize deductions where you previously did not. This means lots of things to deduct against you tax bill. It is already the 22nd of December and you better get crackin'

Once a taxpayer has reached the point where he or she can itemize deductions on the 1040 form, there are many legitimate deductible expenses that can be taken. It may even be worth while to make a few legitimate business purchases based on what you professional tax guy says.

The new tax law passed by the Congress earlier this week may change your ability to itemize deductions so this year could be the year you want to make deductible purchases. The new law will increase the standard deduction by roughly double. This means many people that are itemizing now, may not need to starting next year. Your tax guy can explain the details, but I suggest you find out before the end of the year.

Many homeowners benefit from itemizing deductions and if you own a home with a mortgage you should seek professional tax help to make sure you are not paying MORE than you fair share to Uncle Sam. Let's face it, the IRS is more like a crazy uncle when you think about it. Our elected representatives are not exactly spending YOUR money wisely, so keep as much as you can fairly under the law. Talk to a pro, you only got 4 business days left!

Happy Holidays to all!

Once a taxpayer has reached the point where he or she can itemize deductions on the 1040 form, there are many legitimate deductible expenses that can be taken. It may even be worth while to make a few legitimate business purchases based on what you professional tax guy says.

The new tax law passed by the Congress earlier this week may change your ability to itemize deductions so this year could be the year you want to make deductible purchases. The new law will increase the standard deduction by roughly double. This means many people that are itemizing now, may not need to starting next year. Your tax guy can explain the details, but I suggest you find out before the end of the year.

Many homeowners benefit from itemizing deductions and if you own a home with a mortgage you should seek professional tax help to make sure you are not paying MORE than you fair share to Uncle Sam. Let's face it, the IRS is more like a crazy uncle when you think about it. Our elected representatives are not exactly spending YOUR money wisely, so keep as much as you can fairly under the law. Talk to a pro, you only got 4 business days left!

Happy Holidays to all!

Friday, December 15, 2017

Slight Softening could be Golden Opportunity

Prices are stable in the local market with modest appreciation in values. I am seeing a little bit of a bump in inventory which is a much needed softening of the heavy seller's market we battled last spring.

Buyers that were frustrated over the summer with multiple offers and aggressive competition for property in what was a very tight inventory situation, may find that things tempered a bit. It seems like the number of buyers has lightened a touch and a modest gain in sellers is leveling the market into a healthy near neutral condition that just slightly favors sellers.

This is more evident in the upper price ranges but even in the sub-median market I see openings for buyers. Interest rates are nudging up and that can lower the buying power of buyers. This current moderation in the market coupled with still very low mortgage rates could be a golden opportunity to strike a deal for a house.

The classic fence sitters are faced with an opportunity that may not be around by summer. With rates on government backed mortgages still in the low 4s, and a slight flattening in appreciation, the time is now for buyers. Buyers should remember that historically speaking, any rate under 6% is a "low" rate. We have been under 6% for a very long time so some people may be under the delusion that 5% is a "high" rate.

I have written on this very blog about the dangers of waiting for a better price in a rising rate market. Rate will almost always hurt the bottom line more than price. Most analysts are predicting a modest gain in values for 2018 and rates are trending up which amounts to the classic "double jeopardy" scenario.

Get off that fence!

Buyers that were frustrated over the summer with multiple offers and aggressive competition for property in what was a very tight inventory situation, may find that things tempered a bit. It seems like the number of buyers has lightened a touch and a modest gain in sellers is leveling the market into a healthy near neutral condition that just slightly favors sellers.

This is more evident in the upper price ranges but even in the sub-median market I see openings for buyers. Interest rates are nudging up and that can lower the buying power of buyers. This current moderation in the market coupled with still very low mortgage rates could be a golden opportunity to strike a deal for a house.

The classic fence sitters are faced with an opportunity that may not be around by summer. With rates on government backed mortgages still in the low 4s, and a slight flattening in appreciation, the time is now for buyers. Buyers should remember that historically speaking, any rate under 6% is a "low" rate. We have been under 6% for a very long time so some people may be under the delusion that 5% is a "high" rate.

I have written on this very blog about the dangers of waiting for a better price in a rising rate market. Rate will almost always hurt the bottom line more than price. Most analysts are predicting a modest gain in values for 2018 and rates are trending up which amounts to the classic "double jeopardy" scenario.

Get off that fence!

Friday, December 8, 2017

originally posted 10-21-2016

|

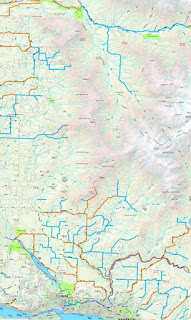

| Snow on ground at 850 feet, no snow in Vancouver on this day |

Here in Clark County we have many neighborhoods scattered throughout the Cascade foothills. Some subdivisions have houses bumping right up against 2000 feet above sea level. In general once you get up above 1000 feet, winter weather is more... well... wintry. Sellers need to be aware that selling property in the foothills up higher than a 1000 feet is not going to produce many showings during the winter months. It is important to maximize the showings by following good showing tactics. Keep the home warm and bright and keep snow clear of the walkways and driveway. But capitalize on winter themes. Often buyers looking up in the mountains during the winter want to have real winter weather. Keep that fireplace stoked and feel free to build a snowman!

Down in the valleys of Vancouver and Portland snowfall is far less common than rain. Locally Vancouver averages about 6 inches a year at Pearson field. But averages are deceiving. There are years that have no snow at all and others that have heaping amounts. Meanwhile, up in the mountains things are more defined. Above a thousand feet it is not a case of if it snows, but rather, how much snow will there be.

Buyers should keep this in mind as well. Many people are looking for a rural home on some acreage. As one moves east generally things start to climb in elevation. Clark County's entire eastern flank is the Cascades with elevations rising up to about 4000 feet before spilling into Skamania County.

When seeking a home up at elevations in the 1000-2000 range which is about as high as you'll find a home in the county, there are a few things to consider. Most higher elevations above 2000 feet are part of the Washington State DNR or the Gifford Pinchot National Forest which do not contain developed neighborhoods.

|

| East County Snow Routes |

Since those monster events are so rare, the county keeps a modest amount of equipment for winter snow removal. Usually most snow events are well handled by the county crews. Those 'snowzilla' events however, will leave the roads snow covered and dangerous. The primary and secondary routes are important if home buyers do not wish to traverse hard-packed, snow-covered roads on a regular basis. Clark County has a published chart showing the snow removal routes for rural areas.

Consider carefully properties that are more than a quarter to half a mile off one of these snow removal routes as travel can be perilous in the mountains when it snows. Remember it may be raining in Vancouver and snowing up in the foothills.

Additional families with school age children should consider school district rules for snow. Generally a wide spread snow event with even modest amounts of snow can trigger a school closure. For mountain dwellers however there will be many days in which schools remain open because it's raining in the valleys and snowing up high. On those days, school buses often run special "snow routes". These will keep buses off the steep terrain and require that parents get the kids to the snow route bus stop on their own. These are things to consider when buying a home above 1000 feet.

It should be noted that most of the time areas between 800-1200 feet don't get huge amounts of snow all at once unless it's during one of the every five years 'snowzilla' event. What happens up around 800-1200 feet is that there is simply more snowy days. 1-2 inches in Vancouver might equate to 3-5 inches at 1000 feet. But there will be 3 to 4 times as many snowy days and as the elevation rises so rises the number of times per year snow falls. Also up above 1000 feet the snow tends to stick around longer than it does down in the valleys.

I would like to note that none of Clark County's incorporated urban areas exceed 800 feet in elevation. The high spot is probably Prune Hill in Camas at just under 800 feet. It is the rural country areas in the Cascade foothills that can be up close to 2000 feet. Buyers worried about snow but looking at traditional suburban or urban neighborhoods need not worry about heavy snow outside of the rare events.

Friday, December 1, 2017

Agents and Clients Need to be Ready For the Routine

Sounds like a , "No Duh" kind of thing, right? Well, I don't know, because it never ceases to amaze me how often routine delays are taken like apocalyptic symptoms of the inevitable end of the transaction in a fiery ball of doom. And sometimes the panic is coming from an agent.

Real estate deals have one thing in common 99% of time, they will have a delay or some mild drama before they are closed. The sun will rise and set at the end of day, and real estate transactions will have someone, somewhere, somehow, need more time for an integral part of the deal. So we know it's coming, we are told in advance it will, yet... EEEEK!! The appraisal is late! Of course it is, it's nearly always late. OH NO! The lender needs some additional documentation! Yes the lender usually does.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

A few things that buyers and sellers can do to protect themselves from these potential issues.

Real estate deals have one thing in common 99% of time, they will have a delay or some mild drama before they are closed. The sun will rise and set at the end of day, and real estate transactions will have someone, somewhere, somehow, need more time for an integral part of the deal. So we know it's coming, we are told in advance it will, yet... EEEEK!! The appraisal is late! Of course it is, it's nearly always late. OH NO! The lender needs some additional documentation! Yes the lender usually does.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.

Don't get mad, don't get even, just relax. It's all good. Better agents will tell their clients about the potential problems in a transaction and this helps keep the lid on the classic "freak out" when there is a typical bump in the road to closing. It is always good advice to expect the best but prepare for the worst.A few things that buyers and sellers can do to protect themselves from these potential issues.

- Do not try to perfectly time the closing of your current home and the closing of the new one. That is a 75% fail rate. Get the buyer of your current home to offer you an optional rent back for at least a week after expected close date.

- Buyer's currently renting; don't give up your rental for at least two weeks after you "expect" to close. This will cost you half a month's rent but it will give you a nice cushion for unexpected delays in closing and will give you time to move without the pressure of the "gotta get out today" syndrome.

- Buyers getting a mortgage; when the loan officer asks for paperwork or other documents no matter how mundane, do it, do it right NOW!

- Buyer's using a loan; Do not move big chunks of money around between accounts. Park your cash in the account you gave the lender and leave it there until you get the keys to the new house.

- Buyer's getting a mortgage; do not borrow money or buy any big ticket items on credit and don't even apply for credit till you get your new house keys. Yes even when the clerk at Macy's says, "if you apply for a Macy's card you get 25% off this whole purchase..." Make like Nancy Reagan and just say NO!

Most real estate transactions will have bumps along the way, don't panic, it's got a 95% chance of being fine. Sometimes deal crushing bad news comes and that is just the way the ball bounces in life; but most of the time it is gonna be OK, so relax, take a deep breath, because you will be closed in no time.

Friday, November 17, 2017

Wow, Holidays... again.

Well the Holidays are upon us and it's time to talk about selling and buying a house in the Holiday season. I have said it again and again, buyers are serious when they are looking at houses between Thanksgiving and the New Year. This is not an ideal time to be outside driving around in strange neighborhoods looking for houses. Yet every year there they are doing just that. Buyers that NEED to buy a house. Many sellers do postpone listing and this can be wise but it can also be a mistake.

Should a home received an acceptable offer during the month of December it is likely that house sale will close in late January or the middle of February. The seller now has an opportunity to look for a replacement house in January when fewer buyers are about and sellers are often motivated. It can be a win-win. Below is last year's comments on selling in the "season".

Originally posted, Friday, November 20th, 2016, by Rod Sager

Sellers often choose to forgo listing their home until after the holidays. It is understandable since most of us would like to take this time of year to spend with family and such. Having a home on the market can be most disruptive. But inventory remains tight, especially in the bottom half of the price range.

Sellers often choose to forgo listing their home until after the holidays. It is understandable since most of us would like to take this time of year to spend with family and such. Having a home on the market can be most disruptive. But inventory remains tight, especially in the bottom half of the price range.

People that are out looking for homes during the holiday season are generally pretty darn serious buyers. Looky-loos and tire-kickers are doing the whole holiday thing. Having a home listed during the holidays can yield strong offers from serious buyers. Really, who is out in the rain and snow looking at houses when they could be inside hanging out with family and friends or at the company party? Real buyers, that's who!

I have offered up tips in the past about prepping a home for a holiday sale, you can look through the archives of Novembers and Decembers past to find useful information on the matter. In general, keep the clutter to a minimum, keep the leaves off the walkways, out of the rain gutters, and off the drive way. If it snows, be sure to keep snow and ice off the walkways and driveway.

Keep pet orders under control. Burn a scented candle with a holiday theme, bake some cookies, and if possible have a fire going during peak showing times. Some people are looking for a very specific house. If your house isn't it, then chances are no amount of warm and fuzzy presentation will sway them. But most buyers are less picky. If your house feels like home, they might just write it up!

I find buyers to be more focused and serious about their purchase during the holidays. Sellers are wise to keep that in mind when making the decision about whether to list now or wait till next year.

Happy holidays, may yours be warm and fuzzy all around.

Should a home received an acceptable offer during the month of December it is likely that house sale will close in late January or the middle of February. The seller now has an opportunity to look for a replacement house in January when fewer buyers are about and sellers are often motivated. It can be a win-win. Below is last year's comments on selling in the "season".

Originally posted, Friday, November 20th, 2016, by Rod Sager

Sellers often choose to forgo listing their home until after the holidays. It is understandable since most of us would like to take this time of year to spend with family and such. Having a home on the market can be most disruptive. But inventory remains tight, especially in the bottom half of the price range.

Sellers often choose to forgo listing their home until after the holidays. It is understandable since most of us would like to take this time of year to spend with family and such. Having a home on the market can be most disruptive. But inventory remains tight, especially in the bottom half of the price range.People that are out looking for homes during the holiday season are generally pretty darn serious buyers. Looky-loos and tire-kickers are doing the whole holiday thing. Having a home listed during the holidays can yield strong offers from serious buyers. Really, who is out in the rain and snow looking at houses when they could be inside hanging out with family and friends or at the company party? Real buyers, that's who!

I have offered up tips in the past about prepping a home for a holiday sale, you can look through the archives of Novembers and Decembers past to find useful information on the matter. In general, keep the clutter to a minimum, keep the leaves off the walkways, out of the rain gutters, and off the drive way. If it snows, be sure to keep snow and ice off the walkways and driveway.

Keep pet orders under control. Burn a scented candle with a holiday theme, bake some cookies, and if possible have a fire going during peak showing times. Some people are looking for a very specific house. If your house isn't it, then chances are no amount of warm and fuzzy presentation will sway them. But most buyers are less picky. If your house feels like home, they might just write it up!

I find buyers to be more focused and serious about their purchase during the holidays. Sellers are wise to keep that in mind when making the decision about whether to list now or wait till next year.

Happy holidays, may yours be warm and fuzzy all around.

Friday, November 10, 2017

A New Market is Emerging

Pay close attention to this headline. A new market? Yes a new market. I am a representative of the last or youngest of the Baby Boomer generation and I have been being 'harassed', imagine a winky emoji here, by AARP for several years already. Baby Boomers have not been driving the real estate market for three or four years. In fact Boomers are rapidly falling in the market as many have already settled into that "final" house. Kids are gone, they downsizing, the whole enchilada of retirement or empty nesting.

Pay close attention to this headline. A new market? Yes a new market. I am a representative of the last or youngest of the Baby Boomer generation and I have been being 'harassed', imagine a winky emoji here, by AARP for several years already. Baby Boomers have not been driving the real estate market for three or four years. In fact Boomers are rapidly falling in the market as many have already settled into that "final" house. Kids are gone, they downsizing, the whole enchilada of retirement or empty nesting.It has been Millennials driving the market and as buyers they represent more than a third of all housing transactions. This generation of young adults is often maligned by the Baby Boomers and often in an unfair way. I am the father of two adult Millennials who like me are at the "young" end of their generation. There are many projections pushed out in the media that Millennials are lazy and living at home well into adulthood, failing to "grow up" et al. Mostly that is B.S.

If one dives into the data beyond the surface, one will find that Millennials have a much harder time getting out on their own due largely to outside economic circumstances rather than any failure to "Grow Up". Sure, being a part of the "participation trophy" era definitely didn't help, but the over-consumption driven economy of their parents is much more to blame. Wages in the US have been stagnant for two decades now and the cost of housing, taxes, and most non-tech products have outpaced income. Millennials, no matter how motivated, will have a tougher time "adulting" than us Boomers had. The deck is stacked against them, but they are holding some good cards to play.

Millennials find themselves facing heavy college debt or low paying non-college degree jobs if they don't have to aptitude for skilled positions like electricians or plumbing, etc. This creates a difficult transition and Millennials often need an extra five years to get on solid financial footing. Millennials are less likely to rush out into the world and fail financially, and this added to the aforementioned higher cost of living, is why we see a longer stay at home period.

The upside is that these young Americans aged roughly from 20-38 are proving to be rather frugal. Not in an annoyingly stingy way, but in a smart financial management sort of way. Surprise! Millennials are going to have savings values more akin to the WWII or 'Greatest' generation than their Boomer parents. Boomers have been a huge consumer driven group and generally poor savers, Millennials are proving to be savvy savers and this is a very good thing indeed.

What does this mean to the real state market? It means that Millennials will continue to drive the market and will likely have nearly half the market share of transactions by the early 2020s. They are now becoming a heavy market influence as did their Boomer predecessors. They however, unlike their parents, are practical, frugal, and well informed. They will be patient, they will save for a down payment, and they will be amazing home buyers.

Builders are in for an abrupt kick in the teeth at least locally. They continue to build giant expensive houses that are more in tune with what Boomers were buying twenty years ago. Boomers are downsizing and many builders are ignoring the fact that Millennials are far less likely to have a large family of more than two kids, and are less capable of buying a "big" expensive house. Sure Millennials would love to have the space, but they are proving to be more cautious with their borrowing.

Millennials with a couple of kids will likely buy more modest homes than their parents. The 2500 plus square foot homes are less appealing to them not because they don't want the space, research says they do want big houses. They are likely to buy a smaller 1600-2000 SF, but nicer quality home, than the cheaply constructed 1990s 'big -n-crappy' homes that dot the landscape of decades past. Millennials are late to the market and many are skipping the 'starter' homes. But in our local high cost market, they are finding that starter homes are all they can swing financially.

Builders need to look ten years ahead yet they are only looking at next year. This bodes well for resale houses as Millennials will buy what they think they can afford. I see this group of young people often spending less than the bank will lend them and that is wise beyond their years. This is in harsh contrast to Boomers and Gen Xers that were spending every last penny their credit would afford them.

A new market is emerging and it is a market looking for practical use of space, modest but spacious dimensions, and high build quality. It is a market filled with people that can actually save for a down payment. This new market is filled with buyers looking for value and demanding quality. These are not bad traits my friends, these are the strong traits of their great grandparents rather than the consumption mentality of the Boomers. Although I have seen a great deal of market data suggesting the Millennial buyers want a big house, they also want to spend less than the bank will lend them, they are frugal, and they appreciate quality. Something has to give and based on the high cost of living locally it is the size of the house that they will skimp on, not quality or value.

For Millennials in the entry level price ranges of expensive markets like our local area, they may have to push the limits of their borrowing capacity. They may not like it, but they will benefit in the long run. Millennials are driving the prices of smaller entry level resale properties up because builders locally are not building what they can afford or are willing to pay. Oddly enough, older Boomers are seeking the same properties as Millennials. Boomers are downsizing and Millennials are practical. It seems we are moving back into a 1960s style of three beds and pair of baths for a large swath of America, Boomers that didn't save enough for retirement and Millennials that can't bust out the big cash of our expensive market. Builders better wise up. because a frugal, practical, and savvy group is coming their way.

Now I am not suggesting that the sizes will return to the 800-1200 foot range of decades long past, but smaller is the new world order in high cost markets like ours. Boomers complain that Millennials want it all and they want it for less. With 80 million of them entering peak earning years over the next ten years, they will drive the market to them. Builders will need to find a way to provide large living spaces with a look and feel of yesteryear while maximizing land use and cost per foot. It's a tall order but it needs to be filled. Get ready America, a new market is emerging, and it looks a bit like the mid-century market we had 50 years ago. It's just that the group is 30 somethings, rather than 20 somethings this go round.

Friday, November 3, 2017

Home Warranties Are Generally Good To Have

I am and have been a strong advocate for home warranties when purchasing a resale home. There are a lot of competitors in the marketplace and that has led to reasonable pricing. Typically a one year home warranty in our local market (Clark County, Washington) runs in the $375-$450 price range. The various companies all try to position them selves ideally in the market and that means that prices and coverage will vary. Which it the best for any individual is a bit subjective.

Objectively, these warranties often cover a great deal of potential problems in the home. Everyone should hire a professional home inspector and I have advocated for that as well on this blog. But home inspectors cannot see the future and what is working fine on inspection day could fail a few months down the road.

My experience with these warranty plans is mostly positive. bear in mind that the insurance company is not going to warranty an item that was already bad when you bought the house. Buyers should hold onto the inspection report as a claim made in the first few weeks of ownership will likely throw a red flag to the insurance company. The inspection showing proper functionality would serve to alleviate any issues an adjuster might have with the claim.

I have found that these warranties are highly valuable. They are relatively inexpensive if you think about it. $400 against a purchase that locally is almost assuredly over $300,000. Should a major issue occur such as a failed furnace or major appliance in the home the cost will be return multi-fold. If nothing happens in the first year the money wasn't wasted and I generally don't complain when nothing breaks in house. I am not sitting about whining about how perfect everything works, "Gee, I wish something would break, I am so bored..." Yeah, that isn't how life works. If nothing fails it's a big Gold Win, If something does fail, the insurance picks up the tab. Win.

These programs typically have a small service fee associated with a claim. $50 or $75 tends to be a common amount. The insurance company then pays to fix or replace the item. I personally had a furnace fail on a house I bought back in the 1990s. I had paid for a warranty and they came out and replaced the entire furnace. It was a $3000 job back in the day and I had paid around $300-$350 for the policy. That is the only claim I every made on a home warranty plan but that one claim has paid for every other policy I ever bought with a stack of cash as change.

Buyers should research the various companies a choose the plan best for them. Cheaper is not always better so pay close attention to what the basic coverage includes and what costs extra before choosing a plan. My experience is that most of these warranty companies have a solid claims service, but do your own checking and pick the best plan for you.

One final note about the difference between Homeowners Insurance and a Home Warranty Plan. They are two completely different things. homeowners insurance protects you and the bank lending on the home from disasters like a house fire, flood, earthquake, tree falling into house, etc. They absolutely DO NOT warranty anything in the home. If your home burns to the ground in a fire, the insurance company pays to rebuild the house and replace lost personal items that you have covered up to whatever policy limits you pay for. The home warranty pays to fix things that fail or wear out.

I highly recommend home warranties. Below are just a few companies offering plans. I am not affiliated with or making a specific recommendation for any of these, but I have some experience with all listed and they have been generally favorable.

Objectively, these warranties often cover a great deal of potential problems in the home. Everyone should hire a professional home inspector and I have advocated for that as well on this blog. But home inspectors cannot see the future and what is working fine on inspection day could fail a few months down the road.

My experience with these warranty plans is mostly positive. bear in mind that the insurance company is not going to warranty an item that was already bad when you bought the house. Buyers should hold onto the inspection report as a claim made in the first few weeks of ownership will likely throw a red flag to the insurance company. The inspection showing proper functionality would serve to alleviate any issues an adjuster might have with the claim.

I have found that these warranties are highly valuable. They are relatively inexpensive if you think about it. $400 against a purchase that locally is almost assuredly over $300,000. Should a major issue occur such as a failed furnace or major appliance in the home the cost will be return multi-fold. If nothing happens in the first year the money wasn't wasted and I generally don't complain when nothing breaks in house. I am not sitting about whining about how perfect everything works, "Gee, I wish something would break, I am so bored..." Yeah, that isn't how life works. If nothing fails it's a big Gold Win, If something does fail, the insurance picks up the tab. Win.

These programs typically have a small service fee associated with a claim. $50 or $75 tends to be a common amount. The insurance company then pays to fix or replace the item. I personally had a furnace fail on a house I bought back in the 1990s. I had paid for a warranty and they came out and replaced the entire furnace. It was a $3000 job back in the day and I had paid around $300-$350 for the policy. That is the only claim I every made on a home warranty plan but that one claim has paid for every other policy I ever bought with a stack of cash as change.

Buyers should research the various companies a choose the plan best for them. Cheaper is not always better so pay close attention to what the basic coverage includes and what costs extra before choosing a plan. My experience is that most of these warranty companies have a solid claims service, but do your own checking and pick the best plan for you.

One final note about the difference between Homeowners Insurance and a Home Warranty Plan. They are two completely different things. homeowners insurance protects you and the bank lending on the home from disasters like a house fire, flood, earthquake, tree falling into house, etc. They absolutely DO NOT warranty anything in the home. If your home burns to the ground in a fire, the insurance company pays to rebuild the house and replace lost personal items that you have covered up to whatever policy limits you pay for. The home warranty pays to fix things that fail or wear out.

I highly recommend home warranties. Below are just a few companies offering plans. I am not affiliated with or making a specific recommendation for any of these, but I have some experience with all listed and they have been generally favorable.

Friday, October 27, 2017

It is autumn again...

Well Halloween is just around the corner. Holy Toledo where the heck did 2017 go? Buying and selling homes in the autumn is a completely different affair. For sellers the flow of would be buyers seems to soften as the cooler weather arrives. This is not just because of weather, but a whole plethora of life events that change the "mood" and availability of buyers.

Well Halloween is just around the corner. Holy Toledo where the heck did 2017 go? Buying and selling homes in the autumn is a completely different affair. For sellers the flow of would be buyers seems to soften as the cooler weather arrives. This is not just because of weather, but a whole plethora of life events that change the "mood" and availability of buyers.Halloween can be a great time to connect with neighbors as parents escort their children through the neighborhood. Sellers with active listings have an opportunity to chat with neighbors at the door or on the curbside while the kiddies get their treats. This could be an opportunity for sellers to remind neighbors of that realty sign in the front yard and ask if they know anyone that wants to live in the neighborhood. Sound corny? Well, it isn't neighbors often do know people they like that are looking for a house.

As for the rest of the autumn / holiday period, I have a few tips and ideas that I have published in the past that I will bring to light again today.

Originally published October 7th, 2016 by Rod Sager

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.It seems like a simple thing but buyers need to have a positive experience when they pull up and then walk up to the house. Getting a soaking at the hands of a clogged gutter sets a negative tone before they even set foot in the home. We never want a negative tone now do we?

The further we march into the cooler, wetter autumn and ultimately the colder and icy winter the more serious buyers braving the elements are. Buyers need to look past the little stuff, but sometimes they don't. Sellers need to pay attention to details to maximize value and bring the highest offer.

Autumn is a truly magnificent time of year and real estate can be quite robust during this period. although the volume drops a little, buyers are more serious and inventory is a little tighter so it is about equal in as far as supply and demand is concerned.

I mentioned in previous posts that the market is still climbing but the steep price appreciation has moderated substantially. I believe this is a healthy condition.

Interest rates have been very low over the last several weeks even by recent standards but they seem to be yo-yo-ing up and down in the threes. Loan officers have to pay attention so as to lock buyers in on one of those fabulous lows in the cycle. In general this is still a great opportunity for buyers. Although buyers may wax nostalgic for the low prices of 3-5 years ago these low rates are amazing and that will ultimately save buyers tens of thousands of dollars over the life of the loan.

Friday, October 20, 2017

Sewer Scopes can save some Heartache

Yes my friends today we are getting down in the gutter filthy and talking some sewer line smack. The sewer line that links a house to the main sewer service is typically buried underground and quietly doers its thing ridding your home of the nasty necessity of life. We all take it fro granted; there it lies out of sight and nearly always out of mind. Seriously, who wants to think about sewage?

Many people that are looking at buying an older home do think about getting the sewer line inspected and this of course is a wise idea. After all a sewer scope is often price well under $150. Sometimes complicated setups in the home connection may cause the price to go up a bit, but 90% of scope jobs are quick and reasonably priced.

Often however people only think to do it on really old houses. The logic is sound, and old sewer line laid in 1945 is indeed more likely to have issues than one laid ten years ago, right? Well, maybe. Sometimes the underground work on new home developments is rushed, sometimes back fill is not exactly proper and sometimes a big old fast growing tree can disrupt an otherwise sound sewer install.

The primary concern is a blockage or serious leak in the line. A blockage often is the result of plant root intrusion. The roots can break into the line through a seam in the pipe fitting. often that is caused by a large root pushing on the pipe or normal decades of ground settling. Below is a video from a sewer line company on you tube that shows a root intrusion on the sewer cam. I am not affiliated with this firm and this video was taken in another area of the country, but still provides a good idea of how the sewer line camera inspections look. This shows a severe intrusion and you can see how this might lead to a backup. It is also important to note that one should never flush any solid objects other than toilet tissue and what comes out of our bodies as those "foreign" objects will log jam against even much smaller root intrusions than this one. Foreign objects includes feminine hygiene products which are the number one cause of self inflicted sewer backs ups.

Another issue is what plumbers refer to as a "belly". This is where do to settling over time or a less than adequate install job the sewer pipe has a dip between the house and the main line in the street. Understand that the vast majority of sewer lines are gravity based. The house sits up high on a foundation and there is a slope from the house to the main buried in the street. When you flush the toilet or run water in the bath or sink that water runs down a pipe and picks up speed as it heads down towards the main line. A belly in the line means that the "water" dips and then has to rise back up. Sewer line slops are often very gentle slope. A standard 4 inch line should have a minimum slope of about 1/8" drop for every 12" of length. A belly in the line at the minimum slope can cause enough of a slowdown to create problems. Sewer problems are not pleasant.

A belly in the line is not always a deal killing event and in some cases the combination of pipe size and actual slope may be enough that it is not a concern. This is best left to the pros who understand the basic mechanics and physic of gravity sewer lines.

I would recommend that sellers do a sewer scope test in advance so they know going in whether there is an issue to address. Of course here in Washington State and probably every other state, once the seller is aware of a problem they have to disclose it, so there is that issue. I personally would rather know what potential issues I may have as a seller before a list my home.

Buyers should always consider having the sewer line checked out, even on newer homes because installers can make mistakes in the installation that can slip by the government inspections. Spending an extra $125-$150 on your inspection to get a potentially $2000-$10,000 dollar repair item checked before you buy is sound advice.

Many people that are looking at buying an older home do think about getting the sewer line inspected and this of course is a wise idea. After all a sewer scope is often price well under $150. Sometimes complicated setups in the home connection may cause the price to go up a bit, but 90% of scope jobs are quick and reasonably priced.

Often however people only think to do it on really old houses. The logic is sound, and old sewer line laid in 1945 is indeed more likely to have issues than one laid ten years ago, right? Well, maybe. Sometimes the underground work on new home developments is rushed, sometimes back fill is not exactly proper and sometimes a big old fast growing tree can disrupt an otherwise sound sewer install.

The primary concern is a blockage or serious leak in the line. A blockage often is the result of plant root intrusion. The roots can break into the line through a seam in the pipe fitting. often that is caused by a large root pushing on the pipe or normal decades of ground settling. Below is a video from a sewer line company on you tube that shows a root intrusion on the sewer cam. I am not affiliated with this firm and this video was taken in another area of the country, but still provides a good idea of how the sewer line camera inspections look. This shows a severe intrusion and you can see how this might lead to a backup. It is also important to note that one should never flush any solid objects other than toilet tissue and what comes out of our bodies as those "foreign" objects will log jam against even much smaller root intrusions than this one. Foreign objects includes feminine hygiene products which are the number one cause of self inflicted sewer backs ups.

Another issue is what plumbers refer to as a "belly". This is where do to settling over time or a less than adequate install job the sewer pipe has a dip between the house and the main line in the street. Understand that the vast majority of sewer lines are gravity based. The house sits up high on a foundation and there is a slope from the house to the main buried in the street. When you flush the toilet or run water in the bath or sink that water runs down a pipe and picks up speed as it heads down towards the main line. A belly in the line means that the "water" dips and then has to rise back up. Sewer line slops are often very gentle slope. A standard 4 inch line should have a minimum slope of about 1/8" drop for every 12" of length. A belly in the line at the minimum slope can cause enough of a slowdown to create problems. Sewer problems are not pleasant.

A belly in the line is not always a deal killing event and in some cases the combination of pipe size and actual slope may be enough that it is not a concern. This is best left to the pros who understand the basic mechanics and physic of gravity sewer lines.

I would recommend that sellers do a sewer scope test in advance so they know going in whether there is an issue to address. Of course here in Washington State and probably every other state, once the seller is aware of a problem they have to disclose it, so there is that issue. I personally would rather know what potential issues I may have as a seller before a list my home.

Buyers should always consider having the sewer line checked out, even on newer homes because installers can make mistakes in the installation that can slip by the government inspections. Spending an extra $125-$150 on your inspection to get a potentially $2000-$10,000 dollar repair item checked before you buy is sound advice.

Friday, October 13, 2017

Market is settling in

I like a more calm and sensible market. When the market is at one extreme or the other, the greedy side of humanity can sometimes rear its ugly head. 6 years ago when the market was down and sellers were desperate, buyers could kick the sellers in teeth with the swagger of an old west outlaw. Then as the market turned into gold the sellers got revenge as the 20016-17 market was difficult for buyers. Sellers tactics were often skirting the fine line of ethics.

Now we see a market that has settled in a bit. Values are still on the rise, but inventory has also risen bit. The median priced home throughout the Portland-Vancouver metro is now barely affordable by the median income earner. This has led to a more sensible market.

We are not in a declining situation but rather the rate of growth is just a little slower. We will probably experience a modest and more "normal" rate of appreciation this next year, perhaps in the 4-6% range. This represents a very healthy and sustainable market. These jack-rabbit hops in prices due tend to create bubbles when they last too long. I am relieved to see than the run up in values has subsided and we are calming the pace to sustainable levels.

Buyers should beware however that strong economic conditions in the future could lead to another 'hop' in a year or two. I am not a modern Nostradamus however so who knows what the near future holds. What we do know is that things have indeed settled in and that is actually good for everyone in real estate.

Now we see a market that has settled in a bit. Values are still on the rise, but inventory has also risen bit. The median priced home throughout the Portland-Vancouver metro is now barely affordable by the median income earner. This has led to a more sensible market.

We are not in a declining situation but rather the rate of growth is just a little slower. We will probably experience a modest and more "normal" rate of appreciation this next year, perhaps in the 4-6% range. This represents a very healthy and sustainable market. These jack-rabbit hops in prices due tend to create bubbles when they last too long. I am relieved to see than the run up in values has subsided and we are calming the pace to sustainable levels.

|

| Zillow Graph for Vancouver, WA |

Friday, October 6, 2017

Crazy Week Ahead!

I have a crazy week ahead my friends so I will be on blogger hiatus till next week. Meanwhile take a look at this:

Although the market is slowing its growth rate just a touch and wages are moving in a better direction, this article still rings true.

The following is an article published nine months ago and based on trending data at that time. The market has softened up a bit, but the rising interest rates coupled with the wage problems discussed in this article could spell trouble if something doesn't give. The President-Elect of the United States is driving at skilled labor jobs and if he is successful that could alleviate the wage to housing slide we have been in for a good long time.

Home prices have returned in most markets to the peaks of 2006-07 but wages have not seen significant increases over that time. Let's hope our economy can start producing real jobs so more Americans can afford a home. In the meantime buyers should pay close attention to rate they perked up in December and appear to have leveled off, for a little while at least.

Fast-Rising Home Prices Plus Slower Wage Growth Could Equal a Problem

By Clare Trapasso | Mar 24, 2016 originally posted here.

As Scooby-Doo would say: Ruh-roh!

Housing prices are rising at a faster pace than wages across the U.S.—and that could spell extra trouble for those looking for a home to call their own, according to a recent RealtyTrac report.

The average worker typically spent about 30.2% of his or her paycheck on the combined mortgages, property taxes, and insurance premiums on a median-price home costing $199,000, according to the report. RealtyTrac looked at housing prices for the first two-and-a-half months of this year as well as U.S. Bureau of Labor Statistics wage data from the third quarter of last year, the most recent available, for the report.

That’s a hefty 26.4% over the first quarter of last year.

Home price growth outpaced earnings in nearly two-thirds, or 61%, of the markets tracked in the report.

“We’re heading in a direction where people are no longer going to be able to afford homes,” says RealtyTrac spokesman Daren Blomquist. “The fear: Is this heading in the direction of a housing bubble?”

The numbers are also a big jump from early 2012 when workers plunked down only about 22.2% of their earnings on their new homes. But it’s a significant drop from the titanic 53.2% that homeowners spent at the peak of the pre-collapse real estate market in 2006.

The report looked at public sales deeds in counties with at least 100,000 residents and average earnings data from the U.S. Bureau of Labor Statistics. Affordability was calculated based on the percent of earnings required to meet a 3% down payment (which, in the world of down payments, is pretty low) as well as make payments on the property taxes, insurance premiums, and a 30-year, fixed-rate mortgage for a median-price home.

Lower interest rates on mortgages have kept home buying still reasonably affordable.

But if those rates, along with home prices, continue to rise—while wages don’t—Blomquist worries only the superwealthy will be able to afford to become homeowners. Or prices could plateau or even plummet.

The worst-hit area tracked by the study: Denver. Buyers in that fast-growing city saw the biggest hikes in the percentage of their wages they shelled out to purchase a new home compared with what buyers had paid in the past.

“Our home values are increasing about 1% a month,” says Denver-area real estate agent Kristal Kraft at the Berkshire Group. “It’s insane. I’ve never seen anything like it.”

The Colorado capital was followed by counties in New York City; Omaha, NE; Austin, TX; San Francisco; and St. Louis.

Brooklyn, NY, was ranked the most populated county where homeowners saw the biggest increase in what they forked over for their personal palaces compared with previous years.

The most affordable market for wannabe homeowners was Boston, when looking historically at how much of home buyers’ paychecks went toward the purchase compared with previous years.

Next up were counties in Baltimore; Birmingham, AL; Providence, RI; and Chicago.

Here’s a surprise: The most populated and more affordable county was Los Angeles.

When housing costs rise faster than salaries, workers will often take a closer look at which jobs they can afford to accept and which parts of the country they can afford to live in, says Daniel Shoag, a public policy professor at Harvard University.

“You basically have a situation where it’s not worth it to move to expensive cities, if you don’t have a high-paying job,” he says. Or they’re just loaded.

However, it isn’t “out of whack” for homeowners nationally to spend about 30% of their paychecks for the roof over their heads, he says.

“But it could put the strain on budgets if [prices] continue to rise,” Shoag says.

Clare Trapasso is the senior news editor of realtor.com and an adjunct journalism professor. She previously wrote for a Financial Times publication and the New York Daily News. Contact her at clare.trapasso@move.com. Follow @claretrap

Although the market is slowing its growth rate just a touch and wages are moving in a better direction, this article still rings true.

The following is an article published nine months ago and based on trending data at that time. The market has softened up a bit, but the rising interest rates coupled with the wage problems discussed in this article could spell trouble if something doesn't give. The President-Elect of the United States is driving at skilled labor jobs and if he is successful that could alleviate the wage to housing slide we have been in for a good long time.

Home prices have returned in most markets to the peaks of 2006-07 but wages have not seen significant increases over that time. Let's hope our economy can start producing real jobs so more Americans can afford a home. In the meantime buyers should pay close attention to rate they perked up in December and appear to have leveled off, for a little while at least.

Fast-Rising Home Prices Plus Slower Wage Growth Could Equal a Problem

By Clare Trapasso | Mar 24, 2016 originally posted here.

As Scooby-Doo would say: Ruh-roh!

Housing prices are rising at a faster pace than wages across the U.S.—and that could spell extra trouble for those looking for a home to call their own, according to a recent RealtyTrac report.

The average worker typically spent about 30.2% of his or her paycheck on the combined mortgages, property taxes, and insurance premiums on a median-price home costing $199,000, according to the report. RealtyTrac looked at housing prices for the first two-and-a-half months of this year as well as U.S. Bureau of Labor Statistics wage data from the third quarter of last year, the most recent available, for the report.

That’s a hefty 26.4% over the first quarter of last year.

Home price growth outpaced earnings in nearly two-thirds, or 61%, of the markets tracked in the report.

“We’re heading in a direction where people are no longer going to be able to afford homes,” says RealtyTrac spokesman Daren Blomquist. “The fear: Is this heading in the direction of a housing bubble?”

The numbers are also a big jump from early 2012 when workers plunked down only about 22.2% of their earnings on their new homes. But it’s a significant drop from the titanic 53.2% that homeowners spent at the peak of the pre-collapse real estate market in 2006.

The report looked at public sales deeds in counties with at least 100,000 residents and average earnings data from the U.S. Bureau of Labor Statistics. Affordability was calculated based on the percent of earnings required to meet a 3% down payment (which, in the world of down payments, is pretty low) as well as make payments on the property taxes, insurance premiums, and a 30-year, fixed-rate mortgage for a median-price home.

Lower interest rates on mortgages have kept home buying still reasonably affordable.

But if those rates, along with home prices, continue to rise—while wages don’t—Blomquist worries only the superwealthy will be able to afford to become homeowners. Or prices could plateau or even plummet.

The worst-hit area tracked by the study: Denver. Buyers in that fast-growing city saw the biggest hikes in the percentage of their wages they shelled out to purchase a new home compared with what buyers had paid in the past.

“Our home values are increasing about 1% a month,” says Denver-area real estate agent Kristal Kraft at the Berkshire Group. “It’s insane. I’ve never seen anything like it.”

The Colorado capital was followed by counties in New York City; Omaha, NE; Austin, TX; San Francisco; and St. Louis.

Brooklyn, NY, was ranked the most populated county where homeowners saw the biggest increase in what they forked over for their personal palaces compared with previous years.

The most affordable market for wannabe homeowners was Boston, when looking historically at how much of home buyers’ paychecks went toward the purchase compared with previous years.

Next up were counties in Baltimore; Birmingham, AL; Providence, RI; and Chicago.

Here’s a surprise: The most populated and more affordable county was Los Angeles.

When housing costs rise faster than salaries, workers will often take a closer look at which jobs they can afford to accept and which parts of the country they can afford to live in, says Daniel Shoag, a public policy professor at Harvard University.

“You basically have a situation where it’s not worth it to move to expensive cities, if you don’t have a high-paying job,” he says. Or they’re just loaded.

However, it isn’t “out of whack” for homeowners nationally to spend about 30% of their paychecks for the roof over their heads, he says.

“But it could put the strain on budgets if [prices] continue to rise,” Shoag says.

Clare Trapasso is the senior news editor of realtor.com and an adjunct journalism professor. She previously wrote for a Financial Times publication and the New York Daily News. Contact her at clare.trapasso@move.com. Follow @claretrap

Friday, September 29, 2017

Autumn is Good!

Autumn is good for real estate. Sellers can capitalize on summer buyers that are ready to pull the proverbial trigger after failing to find something during the busy summer. Buyers, likewise can tap into the sellers that didn't get their home sold done during the hot months, and are now ready to make a deal.

Many sellers are anxious to avoid having their home listed during the holidays and often buyers are leery of trekking out into the cold to look at homes. Autumn is cool and crisp and prime for making a real estate deal that keeps both parties feeling accomplished and successful.

Market trends show that demand has remained steady and inventory has inched up slightly. There hasn't been a real shift in the market just a bit of settling in. We have very healthy and sustainable conditions throughout most of our local market save for a couple of lingering hot spots. I mention a while back the Beaverton, Oregon remains spicy with well priced homes getting snatched up right away often with multiple offers.

Closer to home here in Clark County the median price for a home is snuggled in just above $300,000 and that is manageable for the median household in the region if not a bit challenging for those carrying extra debt, like auto loans and such.

Since I mentioned debt, buyers that are struggling with the higher prices should use credit sparingly. Lenders will measure the amount of income a borrower has against two primary debt metrics. First their is the housing ration. This is a amount of the borrower's total income is going to be used to make the new loan payment. Depending on the loan type and the down payment amount this should not exceed 28% but sometimes can be a fair bit higher. The other metric is the total debt to income and this takes into account all debts such as credit cards, auto loans, etc plus the proposed new mortgage. Generally the standard has been 36% max, but many government backed program will allow that to stretch up as high as 50%.

A good credit score goes a very long way when debt to income ratios starting pushing the boundaries. Buyers should avoid having a lot of debt and should also avoid having too many open to buy accounts as well. I have read many reports that two trade lines on revolving credit is probably all one should have. Check with your trusted lender to get more information on these lending guidelines.

Most people need to borrow money to purchase a house so being well informed and executing a quality credit plan will help get a house or get a better house.

Many sellers are anxious to avoid having their home listed during the holidays and often buyers are leery of trekking out into the cold to look at homes. Autumn is cool and crisp and prime for making a real estate deal that keeps both parties feeling accomplished and successful.

Market trends show that demand has remained steady and inventory has inched up slightly. There hasn't been a real shift in the market just a bit of settling in. We have very healthy and sustainable conditions throughout most of our local market save for a couple of lingering hot spots. I mention a while back the Beaverton, Oregon remains spicy with well priced homes getting snatched up right away often with multiple offers.

Closer to home here in Clark County the median price for a home is snuggled in just above $300,000 and that is manageable for the median household in the region if not a bit challenging for those carrying extra debt, like auto loans and such.

Since I mentioned debt, buyers that are struggling with the higher prices should use credit sparingly. Lenders will measure the amount of income a borrower has against two primary debt metrics. First their is the housing ration. This is a amount of the borrower's total income is going to be used to make the new loan payment. Depending on the loan type and the down payment amount this should not exceed 28% but sometimes can be a fair bit higher. The other metric is the total debt to income and this takes into account all debts such as credit cards, auto loans, etc plus the proposed new mortgage. Generally the standard has been 36% max, but many government backed program will allow that to stretch up as high as 50%.

A good credit score goes a very long way when debt to income ratios starting pushing the boundaries. Buyers should avoid having a lot of debt and should also avoid having too many open to buy accounts as well. I have read many reports that two trade lines on revolving credit is probably all one should have. Check with your trusted lender to get more information on these lending guidelines.

Most people need to borrow money to purchase a house so being well informed and executing a quality credit plan will help get a house or get a better house.

Friday, September 22, 2017

Views on the stingy dime...

I wrote a blog post earlier this week about Vancouver's "secret" view neighborhoods. Although secret may be a little 'strong' there are many places in America's Vancouver that offer pretty solid views with homes that are rather modest in design and price. Most often view property in Clark County, Washington is found in places like Prune Hill in Camas, or along the Evergreen Highway. These neighborhoods have large luxury homes with price tags that make tech tycoons blush.

But there are several spots in the area where small homes from the 1940s and 50s were built in the Heights and many offer excellent views, particularly when the view is facing north as it does in Harney Heights.

Here is that aforementioned blog post:

Originally posted on September 19th, 2017 on 'Enjoy the View' by Rod Sager

Vancouver's Secret View Neighborhood

|

| Photo from RMLS, sold home 2015 |

The broad area referred to as the "Heights" actually is composed of many neighborhoods including, South Cliff, Dubois Park, Evergreen Highlands, Northcrest, and several others as you move east towards Cascade Park. South Cliff and Dubois are rather spendy areas and many of the homes in that area feature spectacular views of the Columbia River and city lights. But Harney Heights is much less pretentious and the homes on the bluff are very reasonably priced when the view is taken into consideration.

Harney Heights is at the west end of the "Heights" area and is immediately east of Vancouver's Central Park area. Most of the homes in Harney heights are WWII and mid century designs. They are mostly modest homes and the vast majority do not feature a view. But all of the homes along the bluff that overlooks Fourth Plain Village have a nice view to the North and many offer a surprisingly breathtaking view of the Mighty Mount Saint Helens. These homes are only about 100 feet higher than the valley floor but the bluff is very steep and it is enough to see over the top of most of the trees in the area.

The result is a pretty nice view of the Cascades including our favorite angry volcano and the surrounding terrain. Of course the night time view will feature all the city lights from the scores of neighborhoods in Northeast Vancouver.

These homes are not terribly expensive. They are generally smaller homes with less than 1600 square feet and many are classic bungalows. The ones with views like the photo will of course fetch a premium, they are still rather affordable many with prices in the $300k range.

Whether you are on the south side of the Heights or taking advantage of deals to north, enjoy the view.

Friday, September 15, 2017

Relaxing conditions, but not everwhere.

The red hot sizzling Portland Metro Real Estate market is showing a definitive relaxation as values have skyrocketed and buyers are starting to thin a little as they are priced out. But not all areas in our beautiful metro area have cooled their jets. Beaverton is still pretty crazy with values continuing to inch up and seemingly no shortage of buyers. Little ramblers from the 1960s and 70s that feature less than 1000 square feet in many cases are commanding middle 300s on price and that is pretty steep for entry level buyers.

More locally here in Clark County as I wrote last week, the craziness has for the most part subsided, but we are still experiencing increasing prices and buyers should not get too complacent. Sellers are a little easier to work with and that is refreshing. But buyers still need to act quickly when they find a house they really like.

Buyers should always remember that a well priced home will sell quickly, possibly with multiple offers. There are however those overpriced units I have referenced over the last few months and the market here in greater Vancouver is no longer supporting egregious overpricing. These are sellers that buyers can 'beat up' a bit. If a buyer is seeking some help with closing costs or just needs a sharper price, the overpriced house may be had for less. The seller may have it sit for a few weeks before considering a lower offer but at some point they will have to come to the market. The strategy of having the market come to them is waning as values are not increasing in annualized double digits any more. Buyers are well advised to have their agent run the numbers on homes that may be overpriced and make an offer accordingly.

I like this moderate, more healthy market. I think people on both sides of a real estate transaction make better decisions when neither side has a clear market advantage. I still feel that this Clark County, WA market in the sub-400k range favors sellers a bit, above 400k is pretty neutral.

Overall the real estate market is excellent.

More locally here in Clark County as I wrote last week, the craziness has for the most part subsided, but we are still experiencing increasing prices and buyers should not get too complacent. Sellers are a little easier to work with and that is refreshing. But buyers still need to act quickly when they find a house they really like.

Buyers should always remember that a well priced home will sell quickly, possibly with multiple offers. There are however those overpriced units I have referenced over the last few months and the market here in greater Vancouver is no longer supporting egregious overpricing. These are sellers that buyers can 'beat up' a bit. If a buyer is seeking some help with closing costs or just needs a sharper price, the overpriced house may be had for less. The seller may have it sit for a few weeks before considering a lower offer but at some point they will have to come to the market. The strategy of having the market come to them is waning as values are not increasing in annualized double digits any more. Buyers are well advised to have their agent run the numbers on homes that may be overpriced and make an offer accordingly.

I like this moderate, more healthy market. I think people on both sides of a real estate transaction make better decisions when neither side has a clear market advantage. I still feel that this Clark County, WA market in the sub-400k range favors sellers a bit, above 400k is pretty neutral.

Overall the real estate market is excellent.

Friday, September 8, 2017

Market Feels a Touch Softer

The market continues to produce a surplus of buyers but sellers seem to be a little more abundant as well. This is a much needed counter balance to the heavy seller's market conditions we saw just six months ago. The MLS is reporting very steady conditions and sales have been flat. Not flat in a bad way but rather just not accelerating like they have been the last few years. This is a healthy market. Buyers have a bit more room to work as more properties are available and multiple offers are not quite as aggressive.

Well priced homes will still get a swarm of offers but homes overpriced will sit a while. Clark County is cranking out around 800 sales a month and that is nothing to sneeze at. Listings are starting to come in and buyers can now actually be a little more selective. It is a still a solid seller's market so buyers shouldn't get too cocky. A nice clean offer is probably the best approach. Don't burden the seller with a complicated purchase and sale agreement. Simple rules the day.

This is a great market we have here and I look forward to a continued steady sales trend that is sustainable over the long haul.

Well priced homes will still get a swarm of offers but homes overpriced will sit a while. Clark County is cranking out around 800 sales a month and that is nothing to sneeze at. Listings are starting to come in and buyers can now actually be a little more selective. It is a still a solid seller's market so buyers shouldn't get too cocky. A nice clean offer is probably the best approach. Don't burden the seller with a complicated purchase and sale agreement. Simple rules the day.

This is a great market we have here and I look forward to a continued steady sales trend that is sustainable over the long haul.

Friday, September 1, 2017

Labor Day is Here.

Labor Day marks the unofficial end of summer. Locally the mercury won't notice as we are expecting some very warm temperatures this weekend. As for real estate, this marks the end of the summer seasonal peak for home activity and that means buyers that have been struggling to find a suitable property in their price range may get a little relief.

No we are not going to suddenly plunge into a buyer's market, but it is moving from a strong seller's market to a weak seller's market and that bodes well for frustrated buyers. The back to school time also tends to put some buyers in a holding pattern. Those buyers will to stay in the hunt may find substantially reduced competition from other buyers and sellers that may be willing to work on price or concessions that a few months ago were nigh impossible to negotiate.

Buck up buyers, this could be your moment. Enjoy the holiday weekend, stay cool, and don't give up, there is a home out there.

No we are not going to suddenly plunge into a buyer's market, but it is moving from a strong seller's market to a weak seller's market and that bodes well for frustrated buyers. The back to school time also tends to put some buyers in a holding pattern. Those buyers will to stay in the hunt may find substantially reduced competition from other buyers and sellers that may be willing to work on price or concessions that a few months ago were nigh impossible to negotiate.

Buck up buyers, this could be your moment. Enjoy the holiday weekend, stay cool, and don't give up, there is a home out there.

Friday, August 25, 2017

Commute Versus Price, A Delicate Balance

Many people are facing a decision about a home that is impacted by the commute they will face when they own it. As prices rise the demand for houses further out from the city center rises. People often have to choose between a bigger and or better house out on the peripheral suburbs or something much smaller or lesser condition in close. Sometimes the magic is in the middle.

People that work in a place like downtown Portland have to carefully weigh the commute. Often times making a long drive in and out of work can seem like no big deal, but it will eventually start to become a drag on the quality of life. Living in a large spacious home in a suburban community like Hillsboro, OR or Woodland, WA can seem like a reasonable drive but a smaller home in Vancouver or SW Portland, might save an hour and a half each day. A lot can be done with an extra ninety minutes.

There may be other issues beyond the drive, schools, parks, and neighborhood quality may be of importance as well, but often these issues can be settled either in close or further out. The general advantage of going further out once someone is out of the inner city, is price.

Locally, Portland is the center of the urban core. In close to Downtown is mostly condos and apartments often in high rise buildings with limited parking and a fair bit of the city noise and issues. As you radiate out of the core you find an eclectic mix of many neighborhoods that offer the single family home with a yard experience but remain in very close to the city center. These are in high demand and are often excessively expensive. Moving out to the ten mile mark opens up NE Portland beyond I-205 and a sizable portion of Vancouver WA as well as Southwest Portland, parts of Tigard, and Beaverton.

Inside this ten mile circle, Vancouver is hard to beat. Traffic is better than most of the rest of the area in the ten mile circle and housing is still reasonable by comparison. There is something about bridges me thinks. Vancouver represents the magic in the middle for commuters to central Portland. A smaller home in the Heights might ultimately prove much better for quality of life than a really big house in Woodland.

Remember, a 30 minute commute versus a 60 minute commute is an hour each way saved! That's an hour a day, 5 hours a week, 21 hours per month. 260 hours per year. 520 hours, that's nearly 11 DAYS per year of extra time sitting in the car!