Some time next month I'll post the numbers for the 2016 local real estate market. It was a solid year by all accounts and I am optimistic about 2017 as well. As a Realtor®, I often find myself encouraging first time home buyers when the market looks like it is making a shift that could impede entry level buyers. It is hard not to come off as a "salesman" trying to "sell" a house but the reality is that entry level buyers with limited resources are the first to be eliminated from the 'dream' when conditions for buyers deteriorate.

What most people consider a great housing market is often not great at all for new buyers to get in. Sure existing homeowners love it that the house they bought 5 years ago is now worth 60% more money, Woo-Hoo! But how many of us have had a 60% increase in wages over that time? Few, my friends, few. The 40k annual salary could buy a nice house in 2012, but today it is 'slim-pickins'.

The latest issue that will effect entry-level home buyers in 2017 is rising interest rates. We already have seen a significant bump up this month, and analysts are pretty much in consensus that the trend for 2017 will continue with a slow rise in mortgage rates. I have mentioned time and time again in this blog that rates are the more deadly virus than rising prices. For renters hoping to grab a slice of the housing pie, your New Year's resolution is clear. It is time to make the move.

Happy New year and warmest wishes for health and prosperity in 2017.

Friday, December 30, 2016

Friday, December 23, 2016

Nationwide Housing Numbers a Nice Gift

It was a very Merry Christmas for those of us in the housing industry from builders, to Realtors® as the nationwide housing numbers came in this week and they looked fabulous. Merry Christmas, Happy Hanukkah and let's all have a Happy New year!

Friday, December 16, 2016

Happy Holidays!

The real estate market is looking good and poised for moderate but healthy growth. Interest rates will likely continue this upward nudging, so buyers need to bear in mind that higher interest rates are often more deadly than a slightly higher purchase price.

The real estate market is looking good and poised for moderate but healthy growth. Interest rates will likely continue this upward nudging, so buyers need to bear in mind that higher interest rates are often more deadly than a slightly higher purchase price.Stay warm, don't slip on the ice, and by all means have a wonderful, safe, and joyous holiday season.

Friday, December 9, 2016

Housing Remains Steady and Strong in Clark County

The data from the local MLS shows that sale of existing and new housing remain locally strong. Inventory is not as tight as it was in the spring but conditions still favor sellers in most price ranges. 2017 may see a slight slowdown in activity, but I believe the many analysts that have suggested moderate growth will persist and healthy conditions should continue into the next year.

One thing that remains a bit of an enigma are those potentially volatile interest rates. Rates have remained at or near the record lows despite the federal government relaxing their position. The stock market is seeing tremendous growth and the interest rate bubble may pop unleashing higher rates over the next few years. This is not necessarily a bad thing as lenders and investors may loosen their underwriting grip when the rates they can charge are higher and thus more profitable.

Historically any rate under 6% is very good. We haven't seen 6% in years. Buyers or existing homeowners should consider making their next purchase or refinance very soon as rates have begun to sneak back up. As long as the equity investment market is booming their is a natural economic pressure on interest rates.

Over the last few months sales of new and existing homes in Clark County have been in or around 600 units. This is a strong healthy condition that should continue into the new year.

One thing that remains a bit of an enigma are those potentially volatile interest rates. Rates have remained at or near the record lows despite the federal government relaxing their position. The stock market is seeing tremendous growth and the interest rate bubble may pop unleashing higher rates over the next few years. This is not necessarily a bad thing as lenders and investors may loosen their underwriting grip when the rates they can charge are higher and thus more profitable.

Historically any rate under 6% is very good. We haven't seen 6% in years. Buyers or existing homeowners should consider making their next purchase or refinance very soon as rates have begun to sneak back up. As long as the equity investment market is booming their is a natural economic pressure on interest rates.

Over the last few months sales of new and existing homes in Clark County have been in or around 600 units. This is a strong healthy condition that should continue into the new year.

Tuesday, December 6, 2016

Christmas at the Coast

Not everyone wants a White Christmas. Really? Yes it's true, some people don't like snow! Well here in the mighty Pacific Northwest, it is safe to say the least likely location for snow on Christmas or any other day, is the beach. The beach rarely gets snow.

Not everyone wants a White Christmas. Really? Yes it's true, some people don't like snow! Well here in the mighty Pacific Northwest, it is safe to say the least likely location for snow on Christmas or any other day, is the beach. The beach rarely gets snow.Many people enjoy staying along the coast during the winter to watch the storms roll in off the ocean, listen to the heavy surf crashing on the beach, and enjoy the majesty and power of the world's largest ocean.

You can see the 2016 events calendar to the left wrapping up this month. The coast is generally quite a bit warmer in the winter time than in the Portland Metro area as the maritime influence is quite strong. Although the Pacific Ocean gets dangerously cold during the winter months with sea temperatures falling into the low to mid 40s, it still acts as a warming influence against the cold air masses that flow into the region. The Portland Metro has much less of a connection to the tempering ocean and so it can be 20 degrees here whilst the coast is enjoying 40s.

I don't want to overstep this my friends; if you are looking for a warm and sunny Christmas, this is not for you. For that you'll need to head south...way south ;) But the shoreline can be such a beautiful place, even in the winter and the power of natural forces can be hypnotic. It will likely be windy and chilly, but the coast can be truly awe inspiring at the holidays.

Friday, December 2, 2016

Homeowners and Taxes: talk to a pro!

I wrote the attached article nearly three years ago but it still carries the same weight today. If you bought your first home this year, you need to get so tax advice.

Originally posted December 20th, 2013 by Rod Sager

Well, did you? If so, you really ought to consider talking to a CPA or a trusted tax professional. This is especially true if you bought your very first home. Our federal tax system is complicated and has both positive loopholes and negative traps. Buying a home is often beneficial to your bottom line on taxes. A tax professional can help you organize your deductions and clarify what you can and cannot "write off".

Prior to owning a home most people do not have enough deductions to justify using the 1040 long form. But once mortgage interest is added to the mix it is quite common to have every reason to itemize deductions. Now all those legitimate deductions you have always had can actually be utilized to save money on taxes. This is why it is so important to see a professional tax advisor.

Trying to itemize deductions on your own can be a very daunting task. Not only is it time consuming, but it is very easy to take a deduction that is not a legal deduction. In an audit, you may get into the proverbial hot water. It may cost anywhere from a hundred to a few hundred dollars to have a professional prepare your taxes, but it is well worth it in my opinion. Even if you are good at accounting and feel comfortable preparing your own taxes, I still think it is sound advice to at least have your taxes prepared occasionally by a seasoned tax professional. A significant change in tax, income or deductions status is a great time to utilize a tax preparer.

The federal government is going to waste your money anyway, so you might as well pay them ONLY what you really owe, right? OK, I know that the government has many viable and necessary expenditures, my tongue was inserted in the cheek on that last comment. But none the less, why pay more than you are required? If you want to give away money, give it to a local charity and help someone who is down and out. Or send me a check...tongue in cheek but less firmly on that one.

I hope everyone has had a spectacular year, I know I did and I am looking forward to an even better 2014. Happy Holidays to all of you. They will be a little merrier if you save money on your taxes this year.

Originally posted December 20th, 2013 by Rod Sager

Did you buy a house this year?

Well, did you? If so, you really ought to consider talking to a CPA or a trusted tax professional. This is especially true if you bought your very first home. Our federal tax system is complicated and has both positive loopholes and negative traps. Buying a home is often beneficial to your bottom line on taxes. A tax professional can help you organize your deductions and clarify what you can and cannot "write off".

Prior to owning a home most people do not have enough deductions to justify using the 1040 long form. But once mortgage interest is added to the mix it is quite common to have every reason to itemize deductions. Now all those legitimate deductions you have always had can actually be utilized to save money on taxes. This is why it is so important to see a professional tax advisor.

Trying to itemize deductions on your own can be a very daunting task. Not only is it time consuming, but it is very easy to take a deduction that is not a legal deduction. In an audit, you may get into the proverbial hot water. It may cost anywhere from a hundred to a few hundred dollars to have a professional prepare your taxes, but it is well worth it in my opinion. Even if you are good at accounting and feel comfortable preparing your own taxes, I still think it is sound advice to at least have your taxes prepared occasionally by a seasoned tax professional. A significant change in tax, income or deductions status is a great time to utilize a tax preparer.

The federal government is going to waste your money anyway, so you might as well pay them ONLY what you really owe, right? OK, I know that the government has many viable and necessary expenditures, my tongue was inserted in the cheek on that last comment. But none the less, why pay more than you are required? If you want to give away money, give it to a local charity and help someone who is down and out. Or send me a check...tongue in cheek but less firmly on that one.

I hope everyone has had a spectacular year, I know I did and I am looking forward to an even better 2014. Happy Holidays to all of you. They will be a little merrier if you save money on your taxes this year.

Friday, November 25, 2016

Happy Thanksgiving and Black Friday

Black Friday today, go get your deals America! I do hope everyone had a warm and wonderful Thanksgiving day. I hope your team won, I wish you and your family the best wishes of this 2016 holiday season.

I would like to thank all of the readers of this blog and all of my clients for their support, may God bless you all.

I am taking the day off, but here is a past Holiday post that still rings true today:

Originally published by Rod Sager, December 5th 2014,

I have said it before and I'll say it again; the holidays are a serious time for real estate. Anybody that is buying or selling during this time of year is very serious about real estate.

Buyers that are out in the weather during a time they could be at office parties, visiting with family, shopping for the elusive perfect gift, etc. is very committed to finding a house in a timely fashion. Otherwise why wouldn't they just put it off until the New Year?

Likewise for sellers. They would probably rather not have people tromping through their home during the holidays, when guests are over, the decorations are up, etc. Yet there they are doing just that. Maybe they just really want to sell their house?

This is a great time to buy or sell. All of the classic "looky-loos" are on hiatus while the serious contenders are still in the game. I will likely close four transactions this month and that is as many as I closed in the summer months. Don't take the holidays off, you might just get everything you want in the month of December!

As always, seller's should be mindful of the basics of presented their home to prospective buyers. This might be the year to keep half of your holiday decorations in the attic. Too much clutter can be a negative. Keep baking all those yummy holiday goodies because buyers love the smell of fresh baked cookies. Keep the walkways clear of tripping or slipping hazards. Keep snow off the driveway and walkway.

Buyers are well advised to keep shopping during the holidays. Sellers are usually easier to negotiate with when they are busy with other aspects of their lives. At the point they have chosen to keep their home open during this month, they are motivated, whether they say so or not.

December is a win-win month for buyers and sellers so neither should shy away from the golden opportunity that December brings to real estate.

I would like to thank all of the readers of this blog and all of my clients for their support, may God bless you all.

I am taking the day off, but here is a past Holiday post that still rings true today:

Originally published by Rod Sager, December 5th 2014,

|

| image from www.azcentral.com |

Buyers that are out in the weather during a time they could be at office parties, visiting with family, shopping for the elusive perfect gift, etc. is very committed to finding a house in a timely fashion. Otherwise why wouldn't they just put it off until the New Year?

Likewise for sellers. They would probably rather not have people tromping through their home during the holidays, when guests are over, the decorations are up, etc. Yet there they are doing just that. Maybe they just really want to sell their house?

This is a great time to buy or sell. All of the classic "looky-loos" are on hiatus while the serious contenders are still in the game. I will likely close four transactions this month and that is as many as I closed in the summer months. Don't take the holidays off, you might just get everything you want in the month of December!

As always, seller's should be mindful of the basics of presented their home to prospective buyers. This might be the year to keep half of your holiday decorations in the attic. Too much clutter can be a negative. Keep baking all those yummy holiday goodies because buyers love the smell of fresh baked cookies. Keep the walkways clear of tripping or slipping hazards. Keep snow off the driveway and walkway.

Buyers are well advised to keep shopping during the holidays. Sellers are usually easier to negotiate with when they are busy with other aspects of their lives. At the point they have chosen to keep their home open during this month, they are motivated, whether they say so or not.

December is a win-win month for buyers and sellers so neither should shy away from the golden opportunity that December brings to real estate.

Friday, November 18, 2016

Fairway Village Revisited

Fairway Village is Vancouver's largest over 55 community and still remains one of the most desirable locations for the over 55 crowd. This community is situated around a gorgeous nine hole gold course with homes ranging from the 1980s to the early 2000s and from condos to large 2000 foot single family homes. This neighborhood still fetches a bit of a premium, but I have seen 2 bed 1 bath condos under 200k and 2 bed 2 bath houses in the mid 200s. Right on the golf course will command a thick premium. I wrote about this community a couple of times over the years on my blog, "Retire to Washington", most recently last year. That article is posted below. FYI: The homes featured in this article were listings in February of 2015 so pricing has no doubt edged up a bit.

I wrote this post on Fairway Village in 2014 and felt like this was an opportunity to talk about it again. I made some modifications to the story to reflect a few positive changes in market conditions (February, 24th, 2015).

Some retirees want to stay in close to town. Services such as shopping and medical offices are nice and close making for easy access with less time and hassle. That frees up more time for the fun part of retirement living.

Some retirees want to stay in close to town. Services such as shopping and medical offices are nice and close making for easy access with less time and hassle. That frees up more time for the fun part of retirement living.

Fairway Village is a community built around a beautiful 9-hole par 34 golf course, in the Cascade Park area of Vancouver, Washington. The community is restricted for persons 55 years and older. There are a variety of homes in the community ranging from condominiums to large single family homes. Many wonderful single level, 2 and 3 bedroom homes are right on the golf course. The 'village' has a nice clubhouse with an in-ground pool and year round activities.

Visit the Fairway Village HOA site for more info about the community.

As a Realtor®, I always enjoy showing and listing homes in Fairway Village. It is just such a great location for retirees. Almost everything you need on a regular basis is inside a one mile radius. Quite a bit of services are well within comfortable walking distance. If you do have to drive it will be a short drive

Cascade Park was developed in the 1970s before the Glen Jackson Bridge was even built. It nearly was incorporated into its own city. As time progressed Cascade Park built eastward until it met up with 164th Avenue or Fisher's Road for the Clark County old timers. As you move east the development becomes newer topping out with homes built in the mid 90s. Fairway Village is on the far east end of Cascade Park.

What makes this location so enticing is a combination of location and neighborhood quality. Fairway Village maintained solid footing even as the real estate market struggled in 2009-2011. It is just that desirable.

164th and Mill Plain Blvd. is the hub of the East Side. Fairway Village is conveniently located at that hub. Here are some distances (linear miles) to nearby services, from the Fairway Village clubhouse.

I took the liberty of pulling some current listings in the Fairway Village community.

$264,900

The home sits on the golf course with easy access and a great view from the backyard. This home features a spacious floor plan all on one level totaling 1469 square feet. There are two bedrooms and two bathrooms

$350,000

This fabulous home has nice private backyard. It is a very spacious one level home with a whooping 1636 square feet of living space. it is also a 2 bedroom 2 bath offering.

This fabulous home has nice private backyard. It is a very spacious one level home with a whooping 1636 square feet of living space. it is also a 2 bedroom 2 bath offering.

Fairway Village is really, a Fair Way place to Retire. Contact me for additional information about opportunities to own property in this wonderful retirement community.

I wrote this post on Fairway Village in 2014 and felt like this was an opportunity to talk about it again. I made some modifications to the story to reflect a few positive changes in market conditions (February, 24th, 2015).

Some retirees want to stay in close to town. Services such as shopping and medical offices are nice and close making for easy access with less time and hassle. That frees up more time for the fun part of retirement living.

Some retirees want to stay in close to town. Services such as shopping and medical offices are nice and close making for easy access with less time and hassle. That frees up more time for the fun part of retirement living.Fairway Village is a community built around a beautiful 9-hole par 34 golf course, in the Cascade Park area of Vancouver, Washington. The community is restricted for persons 55 years and older. There are a variety of homes in the community ranging from condominiums to large single family homes. Many wonderful single level, 2 and 3 bedroom homes are right on the golf course. The 'village' has a nice clubhouse with an in-ground pool and year round activities.

Visit the Fairway Village HOA site for more info about the community.

As a Realtor®, I always enjoy showing and listing homes in Fairway Village. It is just such a great location for retirees. Almost everything you need on a regular basis is inside a one mile radius. Quite a bit of services are well within comfortable walking distance. If you do have to drive it will be a short drive

Cascade Park was developed in the 1970s before the Glen Jackson Bridge was even built. It nearly was incorporated into its own city. As time progressed Cascade Park built eastward until it met up with 164th Avenue or Fisher's Road for the Clark County old timers. As you move east the development becomes newer topping out with homes built in the mid 90s. Fairway Village is on the far east end of Cascade Park.

What makes this location so enticing is a combination of location and neighborhood quality. Fairway Village maintained solid footing even as the real estate market struggled in 2009-2011. It is just that desirable.

164th and Mill Plain Blvd. is the hub of the East Side. Fairway Village is conveniently located at that hub. Here are some distances (linear miles) to nearby services, from the Fairway Village clubhouse.

- 0.40 miles to IHOP Restaurant and nearby professional center

- 0.61 miles to Village Public Storage

- 0.62 miles to Fred Meyer (Grocery/Department store)

- 0.62 miles to East Vancouver Public Transit Hub

- 0.67 miles to Cascade Health Club

- 0.76 miles to Canepa Dental or Oasis Dental

- 0.79 miles to Regal Cinema Cascade 16 movie theatre

- 0.80 miles to Hwy 14 on ramp at 164th Avenue

- 1.03 miles to 164th and Mill Plain (a virtual cornucopia of shopping and services including, Red Robin, Target, Old Spaghetti Factory, Ross, Kohl's, Olive Garden and quite literally hundreds more)

- 1.50 miles to Vancouver Clinic (popular local medical office)

- 1.80 miles to Kaiser Permanente Cascade Park

- 2.07 miles to 192nd and Mill Plain (Walmart, Home Depot, Lowes, JC Penny, 5 guys and much more)

- 3.46 miles to Camas Meadows Golf Course

- 3.64 miles to Peach Health Southwest Washington Medical Center (Major Hospital)

- 3.87 miles to Portland International Airport

- 4.15 miles to Green Mountain Golf Course

- 4.92 miles to Lacamas Lake and Lacamas Park

- 5.25 miles to Westfield Vancouver Mall

- 8.16 miles to Downtown Vancouver

- 9.91 miles to Downtown Portland

I took the liberty of pulling some current listings in the Fairway Village community.

$264,900

The home sits on the golf course with easy access and a great view from the backyard. This home features a spacious floor plan all on one level totaling 1469 square feet. There are two bedrooms and two bathrooms

$350,000

This fabulous home has nice private backyard. It is a very spacious one level home with a whooping 1636 square feet of living space. it is also a 2 bedroom 2 bath offering.

This fabulous home has nice private backyard. It is a very spacious one level home with a whooping 1636 square feet of living space. it is also a 2 bedroom 2 bath offering.Fairway Village is really, a Fair Way place to Retire. Contact me for additional information about opportunities to own property in this wonderful retirement community.

Friday, November 11, 2016

Interest rates are going up, No really they are this time!

So now nearly every analyst is on board that the Fed will in fact need to make a move up on the short term rates. Long term yields are moving up as well. Mortgage rates are finally going to lose the Federal Government's support and rates will begin to normalize. This means that buyers have an cheap money window that is closing. Rates are in the threes and we will start to see them inch up with each meeting of the Fed. Starting in December, yes next month, were are almost certain to see the first of several incremental increases that will lead to a slow rise in mortgage rates.

Buyers, I know the holidays are looming, but now is the time for you to cash in on the biggest Christmas gift of your life, a sub 4% mortgage that will keep on giving long after the 2016 Holidays fade away.

Buyers, I know the holidays are looming, but now is the time for you to cash in on the biggest Christmas gift of your life, a sub 4% mortgage that will keep on giving long after the 2016 Holidays fade away.

Friday, November 4, 2016

Vancouver's Aggressive Apartment Construction, What does it Mean?

Vancouver is undergoing a major construction boom on apartments with some 800 units under construction and another 3700 in the pipeline. What does this mean for local real estate? The rental market in the greater Vancouver area has been under severe pressure as neighboring Portland has also had a huge crisis in the apartment market. That city is also pushing a fat pipeline of some 7000 units under construction and 15,000 proposed. The Portland crisis has spilled into neighboring cities like Beaverton, Gresham, and Vancouver driving demand higher here as well.

Rents were out of control for several years recently and that helped push the entry level real estate market to the brink of un-affordability. Now with some of the pressure off the rental market the housing resale market will likely settle in a bit. Frankly this is probably a good thing. As it is now, appraisers are a month out and lending may tighten a bit after the election.

Sellers in the entry level market under median ought to sell now and capitalize on a mini-peak in the sub-median market and get that mid market home while these super low rates are still in play. Renters still can buy a small house for not much more per month than the price of a two bedroom apartment. This is still a good time to buy with these low FHA and VA rates in the low to mid threes.

Rents were out of control for several years recently and that helped push the entry level real estate market to the brink of un-affordability. Now with some of the pressure off the rental market the housing resale market will likely settle in a bit. Frankly this is probably a good thing. As it is now, appraisers are a month out and lending may tighten a bit after the election.

Sellers in the entry level market under median ought to sell now and capitalize on a mini-peak in the sub-median market and get that mid market home while these super low rates are still in play. Renters still can buy a small house for not much more per month than the price of a two bedroom apartment. This is still a good time to buy with these low FHA and VA rates in the low to mid threes.

Friday, October 28, 2016

Local Realtors are Invaluable Assets

I am meeting with new clients this weekend about selling their lovely home. The odd thing is that they just bought this home a few months ago. I do not have all the details as of yet, but I do know that my new clients bought the house site unseen and moved here from 900 miles away. They utilized one of our national consumer real estate websites to buy the home and the listing agent's office was in Seattle 160 miles away from here.

I won't opine any further on this specific case, but in general my belief is that national websites such as Zillow, Redfin, Trulia, etc. are excellent tools for people searching for homes especially when looking at far away destinations. That is where their practical benefit ends however. There is no substitute for a local pro that understands the nuances of neighborhoods and the other important issues that face homeowners in a new region.

Once a buyer thinks they have narrowed it down to a few homes they want to see, or even offer on, a local pro should be contacted other than the listing agent. It is important not only to have a local agent that understands the local market, but also an agent unaffiliated with the seller. A listing agents greatest obligation is to the seller for which he has a signed contract with statutory language. The listing agent will pay the buyer's agent commission so the buyer is in much better shape using their own agent.

It is important to take the time to ensure you are buying the best house for you at the best price possible and with favorable terms. Buying a home and then having to sell it three months later is rarely a profitable exercise. Buyers need to be sure they have all the proper information before buying a house.

If you find a home on one of the national websites, there are usually buyer's agents listed. Sometimes there will be a preferred or premier, et al. agent. These agents have likely paid the company money for placement. There may also be a few random agents listed that have a profile on the system and list that area as their area of expertise. Be sure to visit the agent's profile before contacting them.

There is no better asset to a home buyer than a local professional looking out for the buyer's best interests, not the seller's.

I won't opine any further on this specific case, but in general my belief is that national websites such as Zillow, Redfin, Trulia, etc. are excellent tools for people searching for homes especially when looking at far away destinations. That is where their practical benefit ends however. There is no substitute for a local pro that understands the nuances of neighborhoods and the other important issues that face homeowners in a new region.

Once a buyer thinks they have narrowed it down to a few homes they want to see, or even offer on, a local pro should be contacted other than the listing agent. It is important not only to have a local agent that understands the local market, but also an agent unaffiliated with the seller. A listing agents greatest obligation is to the seller for which he has a signed contract with statutory language. The listing agent will pay the buyer's agent commission so the buyer is in much better shape using their own agent.

It is important to take the time to ensure you are buying the best house for you at the best price possible and with favorable terms. Buying a home and then having to sell it three months later is rarely a profitable exercise. Buyers need to be sure they have all the proper information before buying a house.

If you find a home on one of the national websites, there are usually buyer's agents listed. Sometimes there will be a preferred or premier, et al. agent. These agents have likely paid the company money for placement. There may also be a few random agents listed that have a profile on the system and list that area as their area of expertise. Be sure to visit the agent's profile before contacting them.

There is no better asset to a home buyer than a local professional looking out for the buyer's best interests, not the seller's.

Friday, October 21, 2016

Selling in the Mountains in the Winter

|

| Snow on ground at 850 feet, no snow in Vancouver on this day |

Down in the valleys of Vancouver and Portland snowfall is far less common than rain. Locally Vancouver averages about 6 inches a year at Pearson field. But averages are deceiving. There are years that have no snow at all and others that have heaping amounts. Meanwhile, up in the mountains things are more defined. Above a thousand feet it is not a case of if it snows, but rather, how much snow will there be.

Buyers should keep this in mind as well. Many people are looking for a rural home on some acreage. As one moves east generally things start to climb in elevation. Clark County's entire eastern flank is the Cascades with elevations rising up to about 4000 feet before spilling into Skamania County.

When seeking a home up at elevations in the 1000-2000 range which is about as high as you'll find a home in the county, there are a few things to consider. Most higher elevations above 2000 feet are part of the Washington State DNR or the Gifford Pinchot National Forest which do not contain developed neighborhoods.

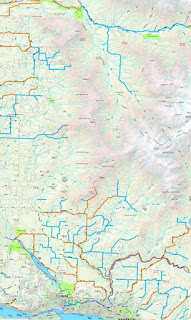

|

| East County Snow Routes |

Since those monster events are so rare, the county keeps a modest amount of equipment for winter snow removal. Usually most snow events are well handled by the county crews. Those 'snowzilla' events however, will leave the roads snow covered and dangerous. The primary and secondary routes are important if home buyers do not wish to traverse hard-packed, snow-covered roads on a regular basis. Clark County has a published chart showing the snow removal routes for rural areas.

Consider carefully properties that are more than a quarter to half a mile off one of these snow removal routes as travel can be perilous in the mountains when it snows. Remember it may be raining in Vancouver and snowing up in the foothills.

Additional families with school age children should consider school district rules for snow. Generally a wide spread snow event with even modest amounts of snow can trigger a school closure. For mountain dwellers however there will be many days in which schools remain open because it's raining in the valleys and snowing up high. On those days, school buses often run special "snow routes". These will keep buses off the steep terrain and require that parents get the kids to the snow route bus stop on their own. These are things to consider when buying a home above 1000 feet.

It should be noted that most of the time areas between 800-1200 feet don't get huge amounts of snow all at once unless it's during one of the every five years 'snowzilla' event. What happens up around 800-1200 feet is that there is simply more snowy days. 1-2 inches in Vancouver might equate to 3-5 inches at 1000 feet. But there will be 3 to 4 times as many snowy days and as the elevation rises so rises the number of times per year snow falls. Also up above 1000 feet the snow tends to stick around longer than it does down in the valleys.

I would like to note that none of Clark County's incorporated urban areas exceed 800 feet in elevation. The high spot is probably Prune Hill in Camas at just under 800 feet. It is the rural country areas in the Cascade foothills that can be up close to 2000 feet. Buyers worried about snow but looking at traditional suburban or urban neighborhoods need not worry about heavy snow outside of the rare events.

Friday, October 14, 2016

Will the Fed Raise Rates in December?

Once the election is over, the Fed will decide what to do about these unprecedented low interest rates. Many analysts are suggesting a rate increase is eminent. This is a concern for many people. If they do raise the Fed rate it will have a negative impact on the mortgages but not horribly so. The Fed is smart enough to know that small incremental increases are the only way to 'safely' raise rates. That said if they are going to raise the rates, is it not wise for those thinking about a refinance or a home purchase to act now, rather than later?

Our market is still seeing a price appreciation. It is not a rapid appreciation like we saw last year and into this spring, but it is rolling along at a sustainably healthy 4-6% annually. So people lallygagging around in the housing market will see the price of homes rise by about 1/2 percent monthly and could see an average mortgage rate increase of 1/4 to 1/2 percent by the end of the year if the Fed raises rates.

Paying more for a house and more interest is not a good combination. Those thinking about a home purchase should strongly consider making their move now. Even if the Fed sits on rates, the monthly price appreciation marches on. The difference of 0.5% seems minor, but that is $1500 on a $300,000 home every month! A quarter point to interest rates will add thousands over the life of the loan. Why not act sooner, rather than later?

Those who are not able to buy now but may be working toward that goal, worry not, rates could go up by two FULL percentage points and still be lower than the 50 year average. It isn't the end of the line if the Fed creeps the rate up a little. In fact it is long overdue. If however a buyer is sitting out there waiting and they are capable of buying now, the waiting serves no real purpose. Below is an excerpt from a past blog post that draws from references I made in my 2010 Book, Don't Panic.

"Many buyers qualified to buy a home a few years ago, but they allowed market fear to get in the way and they hesitated. Now the market has passed them by. When considering an owner occupied property, the time to buy is nearly always now. Yes exceptions are true, buying in late 2007 was not ideal, but one always needs a place to live and even those who bought at the peak before the great crash, still had a home to live in and those folks are now seeing all their equity return. While the home was financially "underwater" it still served its purpose as a shelter. In the grand scheme of things the only bad thing about the value decline was that it limited the ability to sell.

Too many people put too much into the "investment angle" of the home they buy to live in. Yes, we always want to make a sound investment. But unless you are renting out every extra inch of that house, you are not maximizing your investment. I did not buy the house I live in as an investment, I bought it to provide shelter for my family and to use it for my own needs. Its value is not important until I decide to sell it or leverage it. As a real estate professional I do tend to look at the investment side of buying a house even when I intend to live in it, but I never let the investment potential or lack there of, be the overriding factor in the purchase. The primary concern is its use value. Investment potential is supplemental at best."

Home ownership is an important part of our American economic system and both political parties seem to get that. It is one of the few issues in which we have a non-partisan consensus. If you are able the time to act is now.

Our market is still seeing a price appreciation. It is not a rapid appreciation like we saw last year and into this spring, but it is rolling along at a sustainably healthy 4-6% annually. So people lallygagging around in the housing market will see the price of homes rise by about 1/2 percent monthly and could see an average mortgage rate increase of 1/4 to 1/2 percent by the end of the year if the Fed raises rates.

Paying more for a house and more interest is not a good combination. Those thinking about a home purchase should strongly consider making their move now. Even if the Fed sits on rates, the monthly price appreciation marches on. The difference of 0.5% seems minor, but that is $1500 on a $300,000 home every month! A quarter point to interest rates will add thousands over the life of the loan. Why not act sooner, rather than later?

Those who are not able to buy now but may be working toward that goal, worry not, rates could go up by two FULL percentage points and still be lower than the 50 year average. It isn't the end of the line if the Fed creeps the rate up a little. In fact it is long overdue. If however a buyer is sitting out there waiting and they are capable of buying now, the waiting serves no real purpose. Below is an excerpt from a past blog post that draws from references I made in my 2010 Book, Don't Panic.

"Many buyers qualified to buy a home a few years ago, but they allowed market fear to get in the way and they hesitated. Now the market has passed them by. When considering an owner occupied property, the time to buy is nearly always now. Yes exceptions are true, buying in late 2007 was not ideal, but one always needs a place to live and even those who bought at the peak before the great crash, still had a home to live in and those folks are now seeing all their equity return. While the home was financially "underwater" it still served its purpose as a shelter. In the grand scheme of things the only bad thing about the value decline was that it limited the ability to sell.

Too many people put too much into the "investment angle" of the home they buy to live in. Yes, we always want to make a sound investment. But unless you are renting out every extra inch of that house, you are not maximizing your investment. I did not buy the house I live in as an investment, I bought it to provide shelter for my family and to use it for my own needs. Its value is not important until I decide to sell it or leverage it. As a real estate professional I do tend to look at the investment side of buying a house even when I intend to live in it, but I never let the investment potential or lack there of, be the overriding factor in the purchase. The primary concern is its use value. Investment potential is supplemental at best."

Home ownership is an important part of our American economic system and both political parties seem to get that. It is one of the few issues in which we have a non-partisan consensus. If you are able the time to act is now.

Friday, October 7, 2016

Leaves are Coming Down! Fall is Here.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.It seems like a simple thing but buyers need to have a positive experience when they pull up and then walk up to the house. Getting a soaking at the hands of a clogged gutter sets a negative tone before they even set foot in the home. We never want a negative tone now do we?

The further we march into the cooler, wetter autumn and ultimately the colder and icy winter the more serious buyers braving the elements are. Buyers need to look past the little stuff, but sometimes they don't. Sellers need to pay attention to details to maximize value and bring the highest offer.

Autumn is a truly magnificent time of year and real estate can be quite robust during this period. although the volume drops a little, buyers are more serious and inventory is a little tighter so it is about equal in as far as supply and demand is concerned.

I mentioned in previous posts that the market is still climbing but the steep price appreciation has moderated substantially. I believe this is a healthy condition.

Interest rates have been very low over the last several weeks even by recent standards but they seem to be yo-yo-ing up and down in the threes. Loan officers have to pay attention so as to lock buyers in on one of those fabulous lows in the cycle. In general this is still a great opportunity for buyers. Although buyers may wax nostalgic for the low prices of 3-5 years ago these low rates are amazing and that will ultimately save buyers tens of thousands of dollars over the life of the loan.

Friday, September 30, 2016

Market Update

So the seasonal slowdown has arrived. No need to freak out, the summer is generally the busiest time of year often with a 25% bump in monthly transaction volume between May and September. That is beginning to settle back into a more typical autumn pattern. But it should be noted that inventory although still tight has softened a bit and combined with the seasonal adjustment to demand, things are less hectic for buyers. Make no mistake, the market still favors sellers, but the ten offers in ten hours craziness we had in the spring has subsided and sellers seem to be a little bit more malleable.

According to our local MLS service here in Clark County, we are seeing the median days on market creep up a little, but still fast at just 12 days. Median price is still rising but over this summer the prices have stabilized and the increases have been modest. Median sold value in Clark County is hovering right at $300,000. Stabilized pricing is healthy as the real estate market cannot sustain double digit year over year growth for more than a few years.

This is an excellent time for buyers that failed to find a home over the summer or were not prepared to buy in the last few months to jump in. Supply is slightly up and demand is slightly down and that means the market is still very healthy but also a little more accessible. Sellers that were a tad overpriced in the summer months are ready to make a deal as they usually don't want to be selling during the holidays.

I am looking forward to a strong fall season.

According to our local MLS service here in Clark County, we are seeing the median days on market creep up a little, but still fast at just 12 days. Median price is still rising but over this summer the prices have stabilized and the increases have been modest. Median sold value in Clark County is hovering right at $300,000. Stabilized pricing is healthy as the real estate market cannot sustain double digit year over year growth for more than a few years.

This is an excellent time for buyers that failed to find a home over the summer or were not prepared to buy in the last few months to jump in. Supply is slightly up and demand is slightly down and that means the market is still very healthy but also a little more accessible. Sellers that were a tad overpriced in the summer months are ready to make a deal as they usually don't want to be selling during the holidays.

I am looking forward to a strong fall season.

Friday, September 23, 2016

Seller's Need to Relax

This recent upswing to a seller's market has left many seller's with a serious attitude problem and the market is starting to make an unfavorable adjustment. Seller's are finding that buyer's are leaving the market and this has reduced pressure on inventory. It is still very much a seller's advantage, but the craziness of last spring has softened into a more healthy condition.

The problem is that seller's continue to exert pressure on buyer's as if they had ten offers in line when in fact they have just one. Buyer's are leaving the market in frustration. This market has shifted back into a more traditional situation that still favors the seller in the lower portion of the price range up to about 10% above median. But sellers need to actually "sell" their house and being rude, making it difficult to show the home, demanding unreasonable closing periods, etc. are going to lead to disappointment for them. They are leaving cash on the table by pushing away potential buyers with a bad attitude.

Regarding timelines, there are many things delaying closing times right now, the most prevalent is the ridiculous appraisal situation. Appraisers are quoting 4-6 weeks for an appraisal and then extorting cash to get it faster. Right now we have a racket being run by appraisal companies that are basically selling appraisals to the highest bidder. There is no accountability at all and as usual the federal government has screwed the system up. I have heard of appraisals being bid up over $2000. This is a practice so egregious that it would make the Godfather blush.

Locally the cost of appraisals has more than doubled int he last 12 months. It is time for "El Federale" to crack down on these appraisers or better yet mandate that the banks pay all appraisal fees. After all it is the banks that demand appraisals, right? Believe me, if the banks were paying they would kick the appraisers teeth in before succumbing to this latest round of extortion.

Once again the government under the guise of protecting consumer rights has gone off and created a situation where pure unadulterated greed reigns supreme and the ultimate victim of this unregulated catastrophe is of course, the consumer. Classic. I find it interesting that appraisers were offended that they were targeted after the collapse of the market in late 2008. There were some appraisers on the take back then, puffing up prices for dirty loan officers to get cash out refinances pushed through. I have no doubt that these dirty scoundrel appraisers were a minority representation of the industry. But they certainly have not helped buff out the tarnished reputation with this current trend of plundering the public like an 18th century pirate. Ahoy matey, raise the black flag, there be treasure to plunder in thar appraisals...

The problem is that seller's continue to exert pressure on buyer's as if they had ten offers in line when in fact they have just one. Buyer's are leaving the market in frustration. This market has shifted back into a more traditional situation that still favors the seller in the lower portion of the price range up to about 10% above median. But sellers need to actually "sell" their house and being rude, making it difficult to show the home, demanding unreasonable closing periods, etc. are going to lead to disappointment for them. They are leaving cash on the table by pushing away potential buyers with a bad attitude.

Regarding timelines, there are many things delaying closing times right now, the most prevalent is the ridiculous appraisal situation. Appraisers are quoting 4-6 weeks for an appraisal and then extorting cash to get it faster. Right now we have a racket being run by appraisal companies that are basically selling appraisals to the highest bidder. There is no accountability at all and as usual the federal government has screwed the system up. I have heard of appraisals being bid up over $2000. This is a practice so egregious that it would make the Godfather blush.

Locally the cost of appraisals has more than doubled int he last 12 months. It is time for "El Federale" to crack down on these appraisers or better yet mandate that the banks pay all appraisal fees. After all it is the banks that demand appraisals, right? Believe me, if the banks were paying they would kick the appraisers teeth in before succumbing to this latest round of extortion.

Once again the government under the guise of protecting consumer rights has gone off and created a situation where pure unadulterated greed reigns supreme and the ultimate victim of this unregulated catastrophe is of course, the consumer. Classic. I find it interesting that appraisers were offended that they were targeted after the collapse of the market in late 2008. There were some appraisers on the take back then, puffing up prices for dirty loan officers to get cash out refinances pushed through. I have no doubt that these dirty scoundrel appraisers were a minority representation of the industry. But they certainly have not helped buff out the tarnished reputation with this current trend of plundering the public like an 18th century pirate. Ahoy matey, raise the black flag, there be treasure to plunder in thar appraisals...

Friday, September 9, 2016

Bottom is still tight, the rest of the market is settling in.

This article from last year is still resonating in the current market. The prices are all up about 10-12% from the time when this was originally published but it still seems to be the case that the bottom of the market remains tight on inventory and flush with eager buyers. The middle and top however are actually close to a neutral market only favoring sellers a little bit.

Houses under $250,000 are still pretty hot and under $200k it is nigh impossible. As the buyers look up the price ladder they will find less competition in that $350-450k range and that means sellers have to try and play ball.

Originally published, January 9th, 2015, by Rod Sager

"Have you felt trapped in your house over the last few years? Biding your time waiting for the real estate market to correct so you can sell? 2015 may be the year for you. Over the last two years here in Clark County we have seen a roughly 20% increase in the median sale price. Many people that were not able to sell now may find themselves in a positive situation. We very well could be at a turning point of opportunity. For people that are making a move up in price, selling their less expensive house now for a slightly lower amount than they might get next year could prove advantageous. The more expensive house they want will also likely be more expensive. So selling a small house for less to get a big house for less sometimes makes sense.

I saw prices on entry level houses flatten a bit in the second half of 2014. I believe that the market for the 40 year old 3 bed 2 bath home is just about as high as the economy will support right now. Barring any dramatic improvement in the overall economic condition 2015 is a great time to sell an entry level home. Where the market continues to see improving prices is that middle move up. Last summer I ran into situations where a simple 1400 foot ranch home would sell for $220k and a gorgeous 2100 foot home in the same area was fetching just 10% more. I believe that the gap in those market segments should widen this year as the entry level could be flat and the middle will continue to swell in values. Selling the little house to get a big one is prime for 2015. Some people may even find that their house payment is only marginally higher since rates are quite low right now.

Generally a real estate market rebound will begin at the bottom. The bottom of the market can drive the middle. If the bottom is soft so will the middle be. When the bottom begins to move up in value the middle is going to trail behind for at least six months. So that leaves a window to move from the bottom to the middle with the move up house feeling like a bargain. Once the bottom hits the high plateau then there is only a six month window of opportunity to capitalize on the middle lagging behind on growth. This is the gap between the market segments. As an example, entry level homes that were fetching $160,000 two years ago are now selling for $200,000. But the middle houses that were getting $220,000 two years ago are running about $260,000 now. The 25% gain at the bottom and a 16% at the middle translates into a relative deal for the move up buyer. This year there is a good chance the $200,000 house will only rise a little maybe to $210,000 but that middle market is showing signs of activity suggesting the 260,000 house will get to $285,000 this year. So holding out for an extra ten to buy a house that will cost an extra 25 may not be the best approach.

Keep an eye on the real estate trends. Have your favorite Realtor® send you listings so you can keep your finger on the pulse of the market. I can only see trends, I am no Nostradamus, so anything can happen. Real estate is however a very trend based market and it typically follows modestly predictable patterns. Let me know if you have any questions and feel free to comment below."

Houses under $250,000 are still pretty hot and under $200k it is nigh impossible. As the buyers look up the price ladder they will find less competition in that $350-450k range and that means sellers have to try and play ball.

Originally published, January 9th, 2015, by Rod Sager

"Have you felt trapped in your house over the last few years? Biding your time waiting for the real estate market to correct so you can sell? 2015 may be the year for you. Over the last two years here in Clark County we have seen a roughly 20% increase in the median sale price. Many people that were not able to sell now may find themselves in a positive situation. We very well could be at a turning point of opportunity. For people that are making a move up in price, selling their less expensive house now for a slightly lower amount than they might get next year could prove advantageous. The more expensive house they want will also likely be more expensive. So selling a small house for less to get a big house for less sometimes makes sense.

I saw prices on entry level houses flatten a bit in the second half of 2014. I believe that the market for the 40 year old 3 bed 2 bath home is just about as high as the economy will support right now. Barring any dramatic improvement in the overall economic condition 2015 is a great time to sell an entry level home. Where the market continues to see improving prices is that middle move up. Last summer I ran into situations where a simple 1400 foot ranch home would sell for $220k and a gorgeous 2100 foot home in the same area was fetching just 10% more. I believe that the gap in those market segments should widen this year as the entry level could be flat and the middle will continue to swell in values. Selling the little house to get a big one is prime for 2015. Some people may even find that their house payment is only marginally higher since rates are quite low right now.

Generally a real estate market rebound will begin at the bottom. The bottom of the market can drive the middle. If the bottom is soft so will the middle be. When the bottom begins to move up in value the middle is going to trail behind for at least six months. So that leaves a window to move from the bottom to the middle with the move up house feeling like a bargain. Once the bottom hits the high plateau then there is only a six month window of opportunity to capitalize on the middle lagging behind on growth. This is the gap between the market segments. As an example, entry level homes that were fetching $160,000 two years ago are now selling for $200,000. But the middle houses that were getting $220,000 two years ago are running about $260,000 now. The 25% gain at the bottom and a 16% at the middle translates into a relative deal for the move up buyer. This year there is a good chance the $200,000 house will only rise a little maybe to $210,000 but that middle market is showing signs of activity suggesting the 260,000 house will get to $285,000 this year. So holding out for an extra ten to buy a house that will cost an extra 25 may not be the best approach.

Keep an eye on the real estate trends. Have your favorite Realtor® send you listings so you can keep your finger on the pulse of the market. I can only see trends, I am no Nostradamus, so anything can happen. Real estate is however a very trend based market and it typically follows modestly predictable patterns. Let me know if you have any questions and feel free to comment below."

Friday, September 2, 2016

Autumn Is Near

Ah September, the waning days of summer. Here in the Northwest, Autumn comes quick. We can feel the temperatures plummet as fall approaches in the middle of September. Soon the leaves will turn and fall off the trees. For people selling homes in the Autumn it is important to keep the driveway, side walks and rain gutters free of leaves and debris. Slippery and messy leaves are both an eyesore and a potential hazard.

Leaves look beautiful when they first fall on the ground. All those brilliant colors scattered about, make for a storybook setting. But quickly the rain and wind will break them down into a mushy mess. Curb appeal is important and sellers are advised to keep the home as tidy as possible.

On the sales side of thing, this can be a good time to buy. The rush of summer buyers starts to wane a bit and less competition is always good for buyers. often sellers are motivated to get their home competitively priced if it failed to sell over the summer. yes even in a robust buyer's market like this one, sellers sometimes price their home a little too optimistically and find themselves in a September slump. This could be a buyer's opportunity to strike.

Sales in out local market seem to be nearly identical to last year with the exception of prices running about 8-10% higher. The market has been more of a lack of sellers than a flurry of buyers and that doesn't look to be changing anytime soon. Medium demand and very tight inventory is still the state of affairs in the Clark County real estate market.

Leaves look beautiful when they first fall on the ground. All those brilliant colors scattered about, make for a storybook setting. But quickly the rain and wind will break them down into a mushy mess. Curb appeal is important and sellers are advised to keep the home as tidy as possible.

On the sales side of thing, this can be a good time to buy. The rush of summer buyers starts to wane a bit and less competition is always good for buyers. often sellers are motivated to get their home competitively priced if it failed to sell over the summer. yes even in a robust buyer's market like this one, sellers sometimes price their home a little too optimistically and find themselves in a September slump. This could be a buyer's opportunity to strike.

Sales in out local market seem to be nearly identical to last year with the exception of prices running about 8-10% higher. The market has been more of a lack of sellers than a flurry of buyers and that doesn't look to be changing anytime soon. Medium demand and very tight inventory is still the state of affairs in the Clark County real estate market.

Friday, August 19, 2016

Summer Real Estate Trends

Local trends in the market place show a continued healthy market here in Clark County, WA. July showed a slight dip in sales but new listings stayed a bit flat so that gave us a much needed boost in inventory. It was not a big boost but it helps. With 2.1 months available it is still tight and the market still favors sellers. I am finding that the multiple offer feeding frenzy is occurring less often and only on homes that are really well priced. Agents marketing homes at close to fair value are seeing quick turn around but not the craziness of a month or so ago. Sellers looking to puff up their price are finding some market resistance.

Local trends in the market place show a continued healthy market here in Clark County, WA. July showed a slight dip in sales but new listings stayed a bit flat so that gave us a much needed boost in inventory. It was not a big boost but it helps. With 2.1 months available it is still tight and the market still favors sellers. I am finding that the multiple offer feeding frenzy is occurring less often and only on homes that are really well priced. Agents marketing homes at close to fair value are seeing quick turn around but not the craziness of a month or so ago. Sellers looking to puff up their price are finding some market resistance.

This my friends is what a healthy market looks like. Well priced listings attract multiple offers, properly priced listings go pending in less than a month, and over priced listings dangle in the breeze until the market catches up to the puffed up price.

Clark County is sitting at a median sales price of just over 300,000 and growth is showing about 0.4-0.5% monthly gains, which is a healthy annualized number of about 5-6%. Anything higher is not sustainable.

Builders continue to produce new homes, The modern trend of big house on small lot continues as land values and increased state and local regulations push costs higher on land development. Homes in the sub-median price ranges will continue to see robust activity and multiple offers. Above median still seems to be a healthy market with a leaning towards seller favor between the median and $450,000, swinging to neutral from $450k to $750k and still favoring buyers, although only slightly, once above $750k for the most part.

This is a solid and sustainable market and if it continues we will see slight fluctuations between slowing to 2-3% growth then perking up to say 7-10% briefly. All of this based on local and national economic trends.

It's a good market my friends.

Friday, August 12, 2016

Enjoy This Blast from the Past!

Rates continue to remain super low. We have been talking about a low rate bubble for quite some time and it looks like things will stay the same until at least early next year when a new presidential administration will take over.

Originally posted October 16th, 2015, by Rod Sager

Holy Rate Basement Batman! Banks are Practically Giving Money Away!

Have you looked at the mortgage rates lately? Most lenders are offering qualified borrowers a 30 year fixed rate loan at around 3.5% These may not be the lowest rates ever but if not, they are very close to the lowest ever. I have discussed the notion that interest rate is far more important than purchase price especially if one intends to stay in the property for a long term period of seven or more years. Imagine borrowing $240,000 from the bank at 4.5% over 30 years fixed. By all measures this is a good loan at a great rate. The principle and interest payment (PI) would be $1,216 per month. But right now you may very well find lenders offering 3.5% 30 year fixed loans. Now the $240,000 mortgage payment looks more like $1,078. That is a whopping $138 per month less! That is a savings of $16,560 over ten years and nearly 50 grand over the life of the loan! In the heavily paraphrased words of the immortal Doctor McCoy, my God man, why aren't you buying a house!

Seriously my friends, these are truly fabulous times. Sellers will get the strongest offers when rates are low because more buyers will qualify at the higher price. Buyers will get the most bang for their buck at 3.5%. Buyers can also qualify for a lot more money. The same buyer that qualifies to borrow $240,000 at 4.5% will qualify to borrow $270,500 at 3.5%. These super low rates will allow buyers to essentially get 12.5% more money for the same monthly payment. 4.5% is a great rate, 3.5% is a OMG rate! Be sure to check with your favorite mortgage professional as there are a few variables that banks look at such property taxes, mortgage insurance, etc. But in general these are pretty accurate figures.

Yes prices have crept up and many entry level buyers have found themselves in a pickle. But there is a window of opportunity to effectively take 12.5% off the price of a house. Seller wins, buyer wins, everybody wins, except the bank. That my friends is a good scenario. Happy hunting!

Originally posted October 16th, 2015, by Rod Sager

Holy Rate Basement Batman! Banks are Practically Giving Money Away!

Have you looked at the mortgage rates lately? Most lenders are offering qualified borrowers a 30 year fixed rate loan at around 3.5% These may not be the lowest rates ever but if not, they are very close to the lowest ever. I have discussed the notion that interest rate is far more important than purchase price especially if one intends to stay in the property for a long term period of seven or more years. Imagine borrowing $240,000 from the bank at 4.5% over 30 years fixed. By all measures this is a good loan at a great rate. The principle and interest payment (PI) would be $1,216 per month. But right now you may very well find lenders offering 3.5% 30 year fixed loans. Now the $240,000 mortgage payment looks more like $1,078. That is a whopping $138 per month less! That is a savings of $16,560 over ten years and nearly 50 grand over the life of the loan! In the heavily paraphrased words of the immortal Doctor McCoy, my God man, why aren't you buying a house!

Seriously my friends, these are truly fabulous times. Sellers will get the strongest offers when rates are low because more buyers will qualify at the higher price. Buyers will get the most bang for their buck at 3.5%. Buyers can also qualify for a lot more money. The same buyer that qualifies to borrow $240,000 at 4.5% will qualify to borrow $270,500 at 3.5%. These super low rates will allow buyers to essentially get 12.5% more money for the same monthly payment. 4.5% is a great rate, 3.5% is a OMG rate! Be sure to check with your favorite mortgage professional as there are a few variables that banks look at such property taxes, mortgage insurance, etc. But in general these are pretty accurate figures.

Yes prices have crept up and many entry level buyers have found themselves in a pickle. But there is a window of opportunity to effectively take 12.5% off the price of a house. Seller wins, buyer wins, everybody wins, except the bank. That my friends is a good scenario. Happy hunting!

Friday, August 5, 2016

Planning on Collecting a Pension in Retirement?

I write a monthly blog called "Retire to Washington". As far as real estate goes, many people choose to sell the "family" home and 'downsize' to something less formidable when they retire. People sometimes choose to move away from the community they raised the family in as well.

There are multiple factors involved in such decisions. Sometimes parents follow their children so as to be near grandchildren. Sometimes it is an economic decision searching for a place that offers tax relief or other financial advantages for a retiree. Weather can drive the decisions as well and the high number of retirees in Arizona and Florida certainly are indicative of that.

Here in America's Vancouver and Clark County, Washington, we have many ideal conditions for retirees. The title of this post asks if you are planning to collect a pension in retirement. If you are, then Washington State is one of only 7 states in the USA that does NOT tax income. Our neighbor to the south collects an income tax described by industry experts as one of the most aggressive in the country.

Income tax is the biggest government kill-joy for retired people there is. Most folks find themselves in retirement with little in tax deductions. The kids are gone, you're retired so there is no job related deductions, the house is either paid off or nearly so and the interest deduction is all but gone. Then here comes the heavy hand of government to collect their tax. There's little avoiding the feds on this, but at the state level, Washington lets you keep all of your income.

Many people fail to recognize the significance of this deadly combination of income tax and no deductions. In nearby Portland, OR one merely needs to earn a gross of about $16,000 to find themselves in the most common bracket which is a molesting 9%. To put it in perspective, Oregon collects no sales tax, but plunders the average Oregonian for 9% income tax. If one earns $30,000 in taxable income they will bequeath to the 'Empire of Oregon' some $2700. Here in Washington state we do have a state sales tax of 6.5% and locally it is 8.25%. On the surface it may seem close, but stop and think about it. Do we spend every income taxable dollar on sales taxable goods and services. The answer is: hell no, we do not. A person earning a taxable income of $30,000 will likely buy less than $10,000 a year in sales taxable goods. That's less than $825 a year in sales tax and only a third of the burden imposed by the gluttons in Salem down in the Beaver State.

What could you do with an extra $1900 each year? Obviously those with two pensions of a larger retirement income will find this tax savings all too juicy to pass up. The real estate angle is simple. If the sweltering heat of the desert isn't your idea of a comfortable retirement, then skip on Arizona and come straight to Washington State to buy that last house!

As always, I must pull by best Doctor Leonard McCoy impersonation: "I'm a Realtor®, not an accountant"! I am not a tax professional and any decisions made regarding taxation and its effects on your personal situation, should be taken under the advisement of a tax professional.

There are multiple factors involved in such decisions. Sometimes parents follow their children so as to be near grandchildren. Sometimes it is an economic decision searching for a place that offers tax relief or other financial advantages for a retiree. Weather can drive the decisions as well and the high number of retirees in Arizona and Florida certainly are indicative of that.

Here in America's Vancouver and Clark County, Washington, we have many ideal conditions for retirees. The title of this post asks if you are planning to collect a pension in retirement. If you are, then Washington State is one of only 7 states in the USA that does NOT tax income. Our neighbor to the south collects an income tax described by industry experts as one of the most aggressive in the country.

Income tax is the biggest government kill-joy for retired people there is. Most folks find themselves in retirement with little in tax deductions. The kids are gone, you're retired so there is no job related deductions, the house is either paid off or nearly so and the interest deduction is all but gone. Then here comes the heavy hand of government to collect their tax. There's little avoiding the feds on this, but at the state level, Washington lets you keep all of your income.

Many people fail to recognize the significance of this deadly combination of income tax and no deductions. In nearby Portland, OR one merely needs to earn a gross of about $16,000 to find themselves in the most common bracket which is a molesting 9%. To put it in perspective, Oregon collects no sales tax, but plunders the average Oregonian for 9% income tax. If one earns $30,000 in taxable income they will bequeath to the 'Empire of Oregon' some $2700. Here in Washington state we do have a state sales tax of 6.5% and locally it is 8.25%. On the surface it may seem close, but stop and think about it. Do we spend every income taxable dollar on sales taxable goods and services. The answer is: hell no, we do not. A person earning a taxable income of $30,000 will likely buy less than $10,000 a year in sales taxable goods. That's less than $825 a year in sales tax and only a third of the burden imposed by the gluttons in Salem down in the Beaver State.

What could you do with an extra $1900 each year? Obviously those with two pensions of a larger retirement income will find this tax savings all too juicy to pass up. The real estate angle is simple. If the sweltering heat of the desert isn't your idea of a comfortable retirement, then skip on Arizona and come straight to Washington State to buy that last house!

As always, I must pull by best Doctor Leonard McCoy impersonation: "I'm a Realtor®, not an accountant"! I am not a tax professional and any decisions made regarding taxation and its effects on your personal situation, should be taken under the advisement of a tax professional.

Friday, July 29, 2016

Portland Transplants will continue to Drive Local Market

The City of Portland is more of less built out already. In fact a case can be made that Portland has been effectively built out for decades. When a City reaches build out and has no more room to expand, then real estate becomes tight. Portland is surrounded by other cities and protected space so as to have no more room to grow. There is no new land in Portland, only reclaimed land. This makes building in Portland more expensive and thus pushes prices on resale homes ever higher. It is a dilemma faced by many cities in America.

The rising housing prices in our next door neighbor has put pressure on the markets in surrounding areas such as Beaverton, Hillsboro, Gresham, and of course America's Vancouver. These surrounding areas have room to grow and room to build new homes and that keeps the relative price of housing a little lower compared to Portland.

For many years now, Vancouver Washington and Clark County at large has been a primary destination for Portland transplants. We are close to Portland, we have excellent schools, great highways, and a wide variety of housing types from urban high rise condos with stellar views, to Southern California style suburban neighborhoods with 4 beds in a culdesac.

Portlanders continue their exodus into the promised land of Clark County. These buyers flooding our market have pushed the entry level real estate to the brink. They have created a dynamic of puffed up low end houses but the middle market still enjoys some flex in pricing. $275,000 for a dated 1950s rambler but 25k more buys a brand new house the same size. It is an interesting scenario that there is little jump in price from a 1200 SF 3 bed 2 bath and a 5 bed 2.5 bath home in some neighborhoods.

There will always be those who want to live in the "city" regardless of housing costs. They who would live in a one room studio for $2000.00 a month before moving to the 'burbs'. Portland will always be that "city". No matter how big Vancouver USA gets, Portland is the core city for this region. So it (Portland) will continue to produce higher density housing on reclaimed land to keep the real estate market from stagnating and will continue to produce buyers for the adjacent cities like Vancouver, WA. that offer more traditional detached housing at prices that working class people can afford.

There will always be those who want to live in the "city" regardless of housing costs. They who would live in a one room studio for $2000.00 a month before moving to the 'burbs'. Portland will always be that "city". No matter how big Vancouver USA gets, Portland is the core city for this region. So it (Portland) will continue to produce higher density housing on reclaimed land to keep the real estate market from stagnating and will continue to produce buyers for the adjacent cities like Vancouver, WA. that offer more traditional detached housing at prices that working class people can afford.

I suppose this synergenic relationship can benefit both cities. Portland continues its rise among major US cities as it become more urbanized and cosmopolitan, while Vancouver continues its mixed use approach with a rising downtown "city" core and a continuance of some of the urban sprawl.

Here in the 'Couv' we can enjoy the fact that as tight as inventory is it's not as bad as it is south of the river.

The rising housing prices in our next door neighbor has put pressure on the markets in surrounding areas such as Beaverton, Hillsboro, Gresham, and of course America's Vancouver. These surrounding areas have room to grow and room to build new homes and that keeps the relative price of housing a little lower compared to Portland.