Taking this week off. Local winter storm warning is up so please be very careful this holiday weekend! Happy Holidays and best wishes for a great New Year!

Friday, December 24, 2021

Friday, December 17, 2021

Is there an Exodus out of Washington, Like California is Experiencing?

California has been exporting real estate refugees for decades now. States like Arizona, Nevada, Oregon, Idaho, Washington, and more recently Texas have been receiving people looking for opportunity or a better quality of life by the thousands. But is Washington State now slipping into the same pattern? Possibly; the data is suggesting that migration patterns are forming right here in Washington State that look a lot like what California's patterns were in the 1990s.

In California as the major urban centers began to experience strong economic conditions with large employers paying top dollar for talent, the housing costs began to soar in places like Los Angeles, Orange County, San Francisco, and the Silicon Valley. Many people working in the middle class as tradespeople and service sector employees were priced out of the market and began migrating out to far flung suburbs to find affordable housing. Now the demand for those suburbs is so high these same middle class people are seeking out of state or out of the Bay Area opportunities in the above mentioned state and less expensive interior areas of California, like Sacramento and Fresno.

Here in the Evergreen State we have seen a similar situation in Seattle. If you look at Seattle, it looks eerily similar to the San Francisco Bay Area just a decade or two ago. Seattle long ago priced out the service sector and tradespeople who now tend to reside in these far flung suburbs, in Pierce County and Snohomish County. Many Seattleites are packing up and moving here to Vancouver as our high prices are still much lower than the Puget Sound region. The trend looks a lot like California did just a few years back.

But are Washingtonians leaving the state altogether? There is a demonstrably large number of Californians that have left the Golden State behind. Although the state has still seen minor growth that suggests some in-migration is happening as well, they did give up a house seat this past census. Is there a similar scenario here? We have to look at the types of real estate refugees to really find out. I think the answer is yes but on a smaller scale.

There are many reasons for real estate flight. Some people are leaving due to super inflated real estate values that severely reduces the quality of life. The Puget Sound region is definitely experiencing a California style long and slow commute for many middle class families. Here in Vancouver we have reasonable average commute compared to neighboring Portland and Seattle. But some still drive from Vancouver into Portland or even over to the west side for employers like Nike and Intel. That can become a real drag on lifestyle.

There are even political real estate refugees. Yes our divided country is getting so intolerant that some people choose to leave an area because they feel they are outvoted and don't like the direction things are going. This is not uniquely one direction. In fact blue voters are leaving red states and red voters are leaving blue states at relatively similar rates.

But other than random job openings in far away places, most transplants tend to be seeking a better quality of life. That almost always comes down to affordability. Housing is just one part of the equation. You may remember I wrote a blog post a few months back about California counties compared to Clark County and most California Counties are LESS expensive for real estate than our county here. But in California even in a place where housing is affordable, everything else there is more money. Nearly EVERYTHING you buy comes at a premium in the Golden State. The cost of living index takes a variety of things into account and one will find Clark County Washington is not too far off the average for the whole country. There are places in California cheaper overall than Vancouver, WA but it is largely in areas that have lower housing costs. Housing is a big driver in this index and importantly, taxes and child care are not considered.

Take a look at this table National Average = 100:

- Vancouver, WA 118

- Seattle, WA. 167.8

- Spokane, WA 98.6

- Tacoma, WA 118

- Kennewick, WA 98.3

- Bellingham, WA 123.2

- Portland, OR 132.4

- Beaverton, OR 124.7

- Gresham, OR 114.2

- Salem, OR 102.4

- Bend, OR 131.3

- San Francisco, CA 244

- San Jose, CA 215

- Sacramento, CA 121.6

- Fresno, CA 103.3

- Los Angeles, CA 176.2

- San Diego, CA 160.4

- Redding, CA 107.8

- Santa Rosa, CA 141.9

- Riverside, CA 134.1

- Las Vegas, NV. 111

- Phoenix, AZ 108.7

- Denver, CO 127.8

- Salt Lake City, UT 122

- Boise, ID 116.5

- Omaha, NE 76.5

- Des Moines, IA 78.7

- Dallas, TX 101

- San Antonio, TX 89.8

Friday, December 10, 2021

The Darkest Six Weeks in Real Estate

That is a rather ominous title. It just sits there lurking about. Seems a bit scary. Don't worry it's all fine there is no impending demolition of the market or prognosis of doom and despair. But it can feel that way sometimes as we enter the six darkest weeks of the year.

Unless you live in the tropical zone this is the time of year where the days are short and nights are long and cold. Here above the 45th parallel these next six weeks offer about 8 hours of daylight against 16 hours of night. The Pacific Northwest adds that whole cloudy thing to make it even darker. Those car headlights are on at 3pm and even the late sleepers like me, wake up in the dark.

So what the heck does that have to do with real estate? I'm glad you asked. This is time of year for sellers to leave the lights on. Not just the holiday lights but all the lights. Many people will view a listed house after work and that means after dark this time of year. Curb appeal still counts even in the dark. A brightly illuminated home will add a few bucks to your utility bill, but it may add thousands to your sales price. Turning them all on for a showing is fine and well, but many buyers these days will drive around looking at homes they see online. This is there pre-tour and the ones they like they ask their Realtor® to show. If they drive by your listed home and see a dark and uninviting place, they may just scratch it off the list.

Under the cover of darkness and the typical winter landscape, the yard as the initial curb appeal feature is diminished. Sellers should be cautious about having an uninviting and dark front yard and home during the winter months in general. This is particularly important during the six weeks surrounding the winter solstice. Although the three weeks before the solstice have the advantage of holiday displays which are often well illuminated, the New Year typically brings an end to that. Consider adding some solar/battery walkway lights and even lights along the driveway. These can be very inexpensive and provide an inviting and cheery first impression for buyers viewing the home for the first time, especially when doing so when it is dark. That just so happens to be 2/3 of the day round this time of year. The seller's market here in Clark County continues, but it is not as one sided as it was a year or so back. Buyers are more picky, and multiple offers over asking are generally happening on homes that are well prepared for the market. These are the homes that get the big prices and the fast activity. The homes that are just listed as is and with little or no 'staging' may linger in the market and sell for less money.Clark County now has a median home price in excess of $500,000. A five percent price reduction is $25,000. You can do a hell of a lot of staging for 1/5 that amount and it very well may add 3-5% to the final price of the home.

Dark and dreary is not a winning hand unless you are selling to vampires. Expanding your market beyond the bloodsuckers will yield great rewards ;)Friday, December 3, 2021

December is Here and so are some Buyers

I have always said that December tends to be a little slower for buyers but the buyers that are around this time of year are SERIOUS! I recently met a new client through our companies relocation services. He has accepted a new position at a large local employer and is moving all the way from Florida. He has been very serious about this home purchase from day one. He isn't wasting anybody's time and certainly not his own.

December is many things, the holidays, start of winter and miserable weather, end of year stuff, like getting taxes shored up, all that stuff. This is not a time that we typically see lollygagging tire kickers. People out in the hunt this time of year need to buy a house and right now!

Of course I have said much the same about sellers during the holidays. Who wants a bunch of strangers trampling through their house at Christmas-time? No one but sellers that have to sell to take a job elsewhere, or are in contract elsewhere need to sell. They are likely to look at a contingent offer or perhaps an offer slightly under asking if they are priced a little high.

I like the holidays for real estate. People tend to be more serious and focused on the tasks needed to complete real estate transaction. It can be a good time for both buyers and sellers and there is less competition because many people will postpone their listing or buying activities until after the New Year.

Seller's I can't say this enough, keep your drive way and/or walkway to the front door clean and clear of leaves, debris, and snow. Give that buyer every reason to feel good about the house before they open the front door. And buyers likewise, think of the house that doesn't keep things clean and clear as an opportunity for a sharper price, because some buyers may walk past it if curb appeal is low. Especially during the holidays when everyone is tight on time and often not in the mood for any adventures.

Happy Holidays and let's get all these homes sold shall we?

Friday, November 26, 2021

No Black Friday Deals on Real Estate

Just about everything you buy is on sale today but there are a few heavily market driven items that typically ignore Black Friday and real estate is one of them. Reports from the local MLS show that Clark County saw a nearly 15% year over year increase in the median home price. That is a very large increase. Although I feel a little less upward pressure in the market right now, I have no reason to believe that 2022 will not also be robust. I did not predict a 15% boost in 2021 and I certainly don't think we will see that repeated in 2022. But one never knows.

Locally Clark County is getting pressure from two key areas where people are leaving. NO! I'm not going to call out California, because that is not where our market pressure is originating. Number one is Portland, OR. More than ever before Portland is experiencing a bit of an exodus and in fact PSU does a routine data analysis of population trends for the whole State of Oregon and they have seen a dramatic slowdown in the growth of Portland. But the population according to their data is not shrinking.

There is still a positive migration but there is significant turnover happening with Portlanders moving out of the city to areas like Vancouver, Beaverton, Hillsboro, etc. The reason population still shows positive growth is that there are still people moving to Portland mostly from out of the area. Seattle, California, and even mid-western states are a source for new migration to Portland to offset the migration out.

The second source of pressure on our local market is coming from the Puget Sound Region where housing costs are DOUBLE what they are locally. There is a strong migration from the greater Seattle area to Portland and Vancouver as employees are relocating for a better quality of life. The advent of remote working has freed people to move far away form the office to areas with a lower cost of living.

So as long as we remain a desirable spot to live, we will see upward pressure on housing. So no Black Friday deals here in Clark County.

Friday, November 19, 2021

Cowlitz County Market is Sizzling

The local market here in Clark County is still strong, but we have seen slight softening in the intensity. Sellers still have the upper hand, but buyers can find homes and secure them without having to leap before they look.

Head north 40 miles to Longview and Kelso and a different story emerges. That market is roaring like ours was a year or so back. They are getting multiple offers on nearly every house that comes to market. Prices that were once 30-40% lower than Clark County are now more like 20-25% lower. It seems that frustrated buyers in Clark County and perhaps other parts of the metro area have 'discovered' Cowlitz County and are trading in a short commute time for an affordable home.

But how much longer will they remain "affordable" that is yet to be determined. I will be showing a series of homes to an out of state buyer tomorrow in Kelso and Longview as well as a few in Vancouver. My client is in the same situation having to decide whether a 60 mile one way commute is worth the savings or not. We shall see how that plays out.

Houses right now in Clark County need to be priced right. The days of listing at 5-10% over market and getting it are gone. Buyers will not overpay like they did a few years ago. Now the key is having the home price at or very near real market value and having it move in ready. Overpriced and/or rough condition homes will sit a while in the market. I don't think that is the case as much up in Cowlitz, everything seems to be flying off the proverbial shelves there.

I like it when the market moves towards neutral conditions and that seems to be the direction we are headed here in Vancouver and Clark County.

Friday, November 12, 2021

Rod is Away on Business Take a Look at a Classic

Originally published, December 13th, 2019

I have noticed the market has entered the holiday zone. Things are quiet... too quiet ;) Sellers should not fret the slower holiday period because buyers tend to be scarce but serious and the opportunity to sell can come in an instant.I have a client that was thinking about writing an offer on a property that had been listed for a while and not sold yet. Just as the client was ready to pounce, I reached out to the listing agent only to be informed two other buyers made offers and the seller accepted one.

Even in the quiet times buyers are out there and during the holidays buyers tend to be very serious about buying. As I have said time and again, sellers are also serious when they decide to interrupt their holidays to allow showings.

The holidays also tend to knock people off the fence. It's as if a voice inside them is saying, "Let's get this wrapped up for Christmas." Buyers and sellers are often on the same page during this period and both can be a bit more malleable at this time.

December is actually a good month for Real Estate. It isn't a high volume month, but it is an excellent opportunity month.

Friday, November 5, 2021

Is the market slowing down?

So some agents are feeling a tinge of a slowdown and not just the typical seasonal bit. I am not certain if things are actually slowing down or not, prices seem to be holding but activity in general is definitely not as robust as it was this time last year.

Part of the issue certainly could be the fact the prices have gotten out of reach for a large percentage of people. Could that with the fact that the workforce has shrunk during COVID-19 and that certainly leads to fewer buyers. The silver lining is that there is also fewer listings. Adding to that the inventory of new homes is tight because of all the labor and supply shortages.

It would not be a crazy notion to suggest that we are in a bit of an artificial seller's market. If the supply chain issues are resolved and new construction gets back to turning out houses on a 4-5 month build, the lack of qualified buyers might start to make a difference and slow things down.

I have always preferred a neutral sale market in real estate. It tends to keep everyone more honest and faithful in the transactions.

As far as the market trends, things seem to be moving back towards neutrality. The exception would certainly be in that entry level price range under $450,000 where listings are still likely to result in multiple offer scenarios.

Friday, October 29, 2021

Can you own a house for less than rent in Vancouver?

- Monthly rent: $2099.

- Move in cost with no pet / pet : $4198 / $4698.

- Rentals that forbid pets are about 45% of the market.

- Utilities are typically paid by renter but the average is 90%, a fair number of landlords pay the water/sewer bill.

- Typical renter's insurance policy $100

- Rents are currently trending up, suggesting the home will be more expensive next year when lease is renewed.

- Home price : $454,718

- Move in costs 20% Conventional / FHA / VA : $97945 / $15915 / $0

- PITI* Mortgage Payment 20% Conventional / FHA / VA : $2097 / $2696 / $2497**

- Although home values are still trending up, homeowners effectively lock in their payment with a fixed rate mortgage. Property taxes and the cost of insurance can fluctuate in either direction depending on trends.

Friday, October 15, 2021

Vancouver continues high density development, will more city condos follow?

The last 5 years has seen Vancouver's Downtown area add a dozen or more mid-rise and high-rise residential towers. Most have been apartments with the exception of the Kirkland Tower opening very soon, with 40 luxury condo units. Will more condominium units come?

A couple of years ago Washington State made some important revisions to condominium law to make it easier for developers to build them. Primarily revamping the lawsuit section to help soften liability exposure. But since that revision the Kirkland Tower is the only urban condo building to go up. With so many apartments in the city core filling up as fast as they can build them, one might expect to see some condos.

Certainly condo towers are a little more difficult to pencil out whereas rental units can be a cash cow. But the city is looking for long term residents to fill the city center and eventually tenants get tired of making the landlord rich. There are a great many apartments Downtown fetching rents at three times the citywide median. These are people who can certainly afford to buy a condo.

As of now the only condo project not name Kirkland is the proposed 14 story Block 16 development shown on the Gramor Waterfront website. That tower is more in the concept phase at this point. It is an 83 unit proposal versus the 40 units in Kirkland. The building isn't much bigger in size so I'd guess these will be mostly smaller sized units within reach of people that are not multi-millionaires. It's portion fronting the mighty Columbia however suggests the units would be fairly spendy.I's like to see some additional high density condo projects go up downtown to give some ownership opportunity to the thousands of people currently renting in our fantastic and revitalized Downtown.

Friday, October 8, 2021

Real Estate Market Trending Against Economic Factors

The real estate market normally would be affected by swings in the local economy. The underlying economy is strong with unemployment low and demand for goods and services high. But lurking under the surface is a concern that has some economists a bit spooked. Workplace participation is plummeting, recent stats from the Dept. of Labor show only 61% of available labor is employed and roughly 11 million jobs remain unfilled. The trend is leaning towards a worsening rather than improvement. This is not sustainable and without some form of "intervention" a recession is inevitable. Service sector businesses have an abundance of demand that they logistically cannot serve due to supply chain issues and a lack of willing labor.

Typically this lack of employment would lead to a slowdown in market demand for homes. So far the saving grace for housing has been that new housing is suffering from the same labor and supply chain shortages causing a slowdown in new inventory, thus exasperating the tight inventory conditions and keeping home prices trending up, rather than down.

Government continues to coddle those that refuse to enter the workforce to take jobs that are now paying 15-25% over the typical wages pre-pandemic. Half of the homeless population on the West Coast could be working a full time job by the end of this month making enough money to house and feed themselves if only they had the initiative. The other half theoretically could be employed as well, but that half needs genuine help to either overcome drug addiction or mental health issues. Governments need to clean up homeless camps, offer the addicted and mentally ill real opportunity for help and kick the rest out. With no other option those that are able will in fact go to work. There is a basic human need to survive, but so long as camping on the street, begging in the park, and free money from the government continues to be viable, the problem of both homelessness and failing business in a roaring economy will continue until the suppression of local and national economics leads to recession.

If businesses fail because they cannot find employees to serve a major demand for their product or service, that is a government induced problem. There is no need to continue the excessive government payments to unemployed persons when 11 million jobs are out there waiting for workers. The bar is as low as it has been in decades for employability. Nearly anyone with a pulse can earn $15 an hour in our local market and that is enough to pay for half of a two bedroom apartment or to rent a comfortable room in rental house along with food and other necessities.

Until local government pulls its head out from that dark area in the aft section, homelessness, crime, and other social ills will continue. On the national front it is time for the feds to stop handing out money to people that do not need it. The moratorium on eviction and the increased unemployment payments although a bit too generous, made sense in April of 2020 when governments were forcing business to shut down under the threat of what was then a bit of an unknown threat from the COVID 19 virus. By February of 2021 the pandemic conditions were stabilizing and workplaces started to reopen in earnest. That is when the unemployment payment bonus should have stopped and the moratorium on evictions should have stopped shortly thereafter. But they did not. This is why we find ourselves in the most unusual of economic situations with a huge demand for goods and services and a complete inability to serve that demand.

If this economic stagnation continues, interest rates will rise and that will close the door to a large portion of the buyers, then prices will likely soften. If employment returns to pre-pandemic levels or at least close to it, the real estate market should continue to be very healthy. Therein lies the mystery... what will the government do?

Friday, October 1, 2021

To Fix or not to Fix

Many sellers have homes that need some TLC. Maybe the carpets are worn or the interior paint is due for a refresh. It is tempting to sell the house as is in a market as hot as this one. But there remains the notion that fixing the carpet and paint might yield more in the final price than the cost of the work. This is probably true.

With a vacant property the decision is a bit easier as these types of work are more easily completed without ones personal belongings all over. But the contractor market right now is tighter than the housing market. Getting qualified people to fix stuff is hard and as such more expensive than usual. My experience over the years has been that entry level buyers of small single family homes are more likely to buy a light cosmetic fixer than say condo buyers. Although some condo buyers intend to tear out all that dated stuff if the condo is more than 10 years old anyway, the bulk of condo owners are looking for the less demanding home ownership experience.

I have a light cosmetic fixer condo listed right now in the Village at Columbia Shores. This is a wonderful building right along the Columbia River. The seller is letting it go as is. I'll be monitoring the agent remarks and comments to see if I will advise my client to hire out for a fresh paint and flooring. I have always been of a mindset to let the market tell me what it wants, rather than trying the Nostradamus approach whereby I try to conjure up a vision of the future as if I know what the thousands of local buyers are looking for at this very moment. Even after more than two decades experience, I simply don't carry that much hubris. I have said it over and over again, "the market is cold hearted, and it doesn't care about your feelings." It will buy what it wants, and reject what it does not.

That said, patience can be a seller's best friend. Not all sellers have the luxury of time, those that do can wait for the buyer ideally suited to their home. That buyer is out there, we just are not sure when they will arrive. A buyer looking to tear out all the flooring and repaint the home to their personal taste may prefer a slightly less expensive cosmo-fixer since they are remodeling anyway.

For the seller looking for the quick sale, fresh neutral paint will almost always pay for itself at the closing table.

Friday, September 24, 2021

Autumn is Here, Get Ready Sellers

Sellers would be wise to prep their homes for Autumn weather. I wrote a blog about selling in the non-summer months and it still applies today. Rain, wet leaves, and even some snow are on the way over the next few months. Making your home shine during the wet season will give you a leg up in this hot market.

Buyers: you can do the opposite, look for houses with overflowing rain gutters and slick leaf covers walkways; be careful of course it's slick out there. Those homes will likely have a little less attention from competing buyers and will very likely sell for a little less than house that has everything together for the season.

Check out the blog post here for ideas:

Originally published October 7th, 2016 by Rod Sager OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.

OK sellers, the leaves are starting to turn color and some trees are dropping already. Yes my friends it is in fact October and that is what happens this time of year. Sellers need to keep the gutters clear as overflowing gutters are an easy fix yet manage to suck the curb appeal away.

It seems like a simple thing but buyers need to have a positive experience when they pull up and then walk up to the house. Getting a soaking at the hands of a clogged gutter sets a negative tone before they even set foot in the home. We never want a negative tone now do we?

The further we march into the cooler, wetter autumn and ultimately the colder and icy winter the more serious buyers braving the elements are. Buyers need to look past the little stuff, but sometimes they don't. Sellers need to pay attention to details to maximize value and bring the highest offer.

Autumn is a truly magnificent time of year and real estate can be quite robust during this period. although the volume drops a little, buyers are more serious and inventory is a little tighter so it is about equal in as far as supply and demand is concerned.

I mentioned in previous posts that the market is still climbing but the steep price appreciation has moderated substantially. I believe this is a healthy condition.

Interest rates have been very low over the last several weeks even by recent standards but they seem to be yo-yo-ing up and down in the threes. Loan officers have to pay attention so as to lock buyers in on one of those fabulous lows in the cycle. In general this is still a great opportunity for buyers. Although buyers may wax nostalgic for the low prices of 3-5 years ago these low rates are amazing and that will ultimately save buyers tens of thousands of dollars over the life of the loan.

Friday, September 17, 2021

Local Government Policy Impacts Neighborhood Values

All too often Americans tend to focus on the big National Elections like every fours for President, and six years for US Senators and the bi-annual election of US House Reps. But the Mayor, City Council and State legislators are every bit as important and sometimes MORE important.

Pay attention to those local candidates and what they are saying, because your property values can be significantly moved for better or worse depending on the things local officials try to mandate or eliminate. For example the homeless situation. Many governments are making decisions that seem to encourage homelessness rather than discourage it.

Your neighborhood values will crash faster than car with its brakes failed if the homeless start camping nearby. Cities often tend to push the homeless out of nicer areas and into more modest neighborhoods which is neither fair nor appropriate. yet they do it. It seems the wealthy donors can get rid of the problem by dumping it into someone else's neighborhood.

Government officials that claim to be "compassionate" to the homeless are often the ones passing regulations that enable people to live on the streets rather than incentives for them to get a job and have a more stable housing situation.

I certainly do not have all the answers, but I will say one only need to travel around in Portland to see what NOT TO DO.

Here in Vancouver USA we have our mayoral election in off years including 2021. Unfortunately odd year general elections have much lower turnout. Madam Mayor Anne is up for reelection in November. I suggest everyone living in the city proper pay attention to all the candidates positions on various issues. No matter what happens at the State or National level, your property values are most affected by local officials and your property is likely the largest asset you have. Pay attentional and for heaven's sake VOTE!

Friday, September 10, 2021

Looking for Value in this Crazy Market?

But value is not necessarily driven strictly by price. Often I find buyers and sellers hooked on the notion of price per square foot. I even see experienced agents caught in the trap. Read my article on Price Per Foot here. Price per square foot is not a good comparative measure of value at all unless the the properties compared are very similar. A two story house is not similar to a one story house because it is the same size. A fancy house with decadent finishes is not comparable to a similar sized house with cheap finishes. An immaculately well maintained home is not comparable to a run down fixer. Yet people are fixated on price per foot.

When considering price per foot however a value proposition does manifest in the numbers. Ranch homes are expensive for several reasons. First a ranch home has a larger foot print on the lot. Land values locally are very high and represent a very expensive fixed cost. Smaller houses on expensive lots will have a much higher price per square foot than a larger house on the same lot. This is why you will find brand new construction scenarios all over the area where a 1400 foot ranch is $500,000 and a 2000 foot two story is $535,000. The better deal is CLEARLY the larger house. One story homes are also in higher demand because older buyers are often seeking to avoid stairs. In the entry level market smallish one level homes are getting heavy interest from first time home buyers and older retirees downsizing from the family sized house they selling. This creates more buyers for ranch homes, thus inflating their price and price per foot even further.

First time homebuyers that are looking for as much footage as possible inside a tight budget will often find that two story houses are the best way to get more feet for less dollars. There are downsides to small two story homes. If you have a two story house with 1700 square feet it is common to have space upstairs over the garage. In many cases there may be as little as 700 squares on the main level and 1000 squares upstairs. First floor space is more valuable than upper floor space a traditional single family home. That means in general you have a lower price per foot and thus a "value" relative to a one level home. Furthermore, a two story house with equally square footage has a smaller footprint on the lot so you get more yard space on the same sized lot. Again, more "value." Pricing on two story houses in the entry level market are better in general for these reasons and the fact that older people are not interested in these houses.

There is a disadvantage to small two story designs, mostly in the fact that they can sometimes feel a bit cramped on the main level. If you can get past that, the best deals are going to be on small two story homes with less than 2000 sf.

Friday, September 3, 2021

Just when I thought things were quieting down

This market still has a frenzied group of buyers looking for nice clean homes in the mid-price range. Locally a half million dollars is still a mid-range home, but that is quickly slipping towards the entry level.

A thick stack of offers is a good thing and I suppose the "slowdown" was all in my head. Buyers will swarm to clean, move-in ready homes and this house is proof positive our market is still sizzling.

Buyers you have to be ready to make concessions and not just coming in with a bigger price. Sometimes the terms matter. Letting the seller have a few bonus days to get out after close, or coming in with shorter contingency periods for inspections and loan closing. As hard as it is to be a buyer right now, sellers are in the same predicament when they sell they typically become a buyer.

So here's to the second half of 2021 and a continuation of our robust market, hopefully some extra inventory will fill in the gaps and take some heat off of buyers.

Friday, August 27, 2021

Parents Fleeing Public Schools... What will that mean for Real Estate Values?

The COVID-19 pandemic seems to have been the proverbial "last straw" for many parents regarding public schools. Public schools have long been in decline in the USA and now with COVID protocols and remote learning, mask mandates, and all of the other knee jerk reaction to this pandemic, many parents find themselves home-schooling or paying for private school. The numbers are actually a bit shocking in a state like Washington that has some of the best public schools in America.

Many Clark County school districts are seeing significant enrollment reductions despite massive growth in local population. As is seemingly true with all government entities, they rarely see it coming and often are too sloe to react. School districts are directly funded on a per student basis. District leadership continues to bludgeon parents with unpopular changes to teaching curriculum and a sizable percentage of the public is fed up.

Parents want their students to get an education, in elementary school a rounded mix of English, math, and science as a base for secondary schools where more sophisticated concepts can be introduced. Our schools seem to be off the rails with politics mixing in. There is no place for partisan politics in our public schools, yet they seem to be there anyway. Parents are clearly frustrated and not just one side of the political isle, this has become an almost unifying issue.

So what does this mean for real estate values? There are several areas here in Clark County where neighborhood values are higher largely due to the presence of highly rated public schools. I have often argued that the difference between the best and most popular schools and the least popular is pretty minimal. Washington has an iron clad constitutional mandate to keep all public schools well funded. But that doesn't stop people from paying a premium for neighborhoods with well reviewed schools or districts that have more premium infrastructure.

Parents seeking the best public schools are probably the same parents now making alternative education decisions. Property values that have been driven up over schools could see a slowdown in popularity as parents decide to buy a in a less expensive neighborhood and home school or send the kids to private school. The data is in and it is clear that in person instruction is very important to developing children academically. Hopefully the idiots running the schools at the state level will realize this before the schools suffer tremendous funding shortfalls.

In the mean time, why would a family pay an exorbitant premium for a particular school district if they are not going to send their kids to those schools anyway. That may spell trouble for those neighborhoods over the next few years.

Friday, August 20, 2021

Local Market Remains Hot

Yes the headlines are mostly true, the real estate market continues to see strong sales and demand is still outstripping supply. A lot of this locally can be partially tracked to the new home construction which is suffering from supply chain woes. Nearly a thousand resale homes closed in July this year and that is getting into the numbers we saw at the peak of the last big bull housing market in 2007.

Buyers can at least take solace in the inventory numbers that are softening a bit. Instead of ten multiple offers on the three-two with a yard for $400k there might only be five. Of course many sellers are opting to take a more leisurely approach to selling with a higher price intending to bring the buyer that really wants the home rather than the mad rush desperadoes trying to edge each other out.

The extra inventory is appreciated but the market will still gobble it up. There are a fair number of locals moving out of the area, chasing jobs in markets where COVID is not as restrictive on the factories, and supply chain. Texas is a big recipient of this minor exodus. Locally the housing is rapidly being bought by others moving in. We are starting to fill up with Seattle area transplants working from home and taking advantage of Clark Counties relative value when contrasted with King or Snohomish counties. That and all the Portlanders fleeing that rapidly declining city to Clark, Clakamas, and Washington counties.

The next 6-12 months look solid for Clark County real estate.

Friday, August 13, 2021

Inventory Finally Showing Up

Inventory pressure is finally started to lighten up a little. New construction is booming but a labor and materials shortage is keeping things moving at a slower pace than demand. This of course puts pressure on the resale market as more sellers realize they have the upper hand.

Most people have been sitting on their homes, perhaps the fear associated with the pandemic or the where will I go question that looms over many potential sellers. Whatever the underlying cause, the market is seeing a welcome bump in inventory.

That mentioned, we still have a low supply and multiple offers are still the typical situation on any home under $1,000,000 that is priced properly. So buyers you can't quite relax yet. The good news is that most analysts are still mildly to moderately bullish on real estate through the 2nd quarter of 2022.

What might put the brakes on a roaring industry is inflation and potential rate hikes that typically arise during heavy inflation cycles. Projections for the rest of this year are almost "Jimmy Carter " levels of inflation. Buyers in contract now should have a solid 1st year of appreciation. I'd like to think the fed has learned how to keep interest rates in check but they still can't continue to pump cheap money into the economy. At some point rates will creep up.

Rates have been stupid low for several years now. It would be heathy to get back into more normalized rates in the 5's or 6%. That would trim a lot of buyers out of the market though. Getting in while rates are low and locked in on a 30 year at 3% is beneficial in a potentially rising rate economy.

There is a silver lining to the dark cloud hanging over buyers.

Friday, August 6, 2021

Will You Soon Have a City Funded Homeless Camp in Your Backyard?

These campsites will almost certainly affect property values for home owners and businesses nearby. They won't be building these in the posh neighborhoods on Evergreen Highway will they? Certainly not. These will likely get dumped into middle and lower class neighborhoods causing a decline in neighborhood stability, heath, and safety. These camps will cause a loss of value to property owners that often had to claw their way into this expensive housing market. They had to dump their last few nickels and dimes to buy the house, then pump their heart and soul into making it their home. Now here comes the lazy city council that just punts the homeless problem into their neighborhood.

So what will the city do to impacted residents and businesses? The city will do absolutely NOTHING to protect tax paying residents from the impact of this program unless the concerned citizens of Vancouver show up at City Hall and demand it. This means residents need to show up at City Hall and voice their concerns, and ask the city to release the proposed or approved locations of these camps. If no one stands up to demand accountability, no one will get accountable behavior from elected officials. This camp action is a 'punt' that avoids dealing with the underlying issues that lead to homelessness. Permanent homelessness is not an affordable housing issue as much as it is a drug abuse, and mental health issue.

People all too often confuse these types of "solutions" with compassion. This is not compassion, this is an action that simply perpetuates the problem, and as witnessed in Portland, brings MORE homeless people into the region seeking the amenities afforded by these structured facilities. No my friends, this is not compassion. The compassionate thing to do is to get these people off the streets and into stable housing. This means providing drug intervention, mental health facilities, and job placement opportunities.

There are some people who do not wish to be helped, they refuse to accept help and in open defiance will camp on our streets, urinate and defecate in parks, or perhaps worse in a creek that leads to the Columbia River while leaving trash to blow in the wind and clog our waterways ultimately adding to the Pacific Ocean Garbage Island. This campsite plan does at least address the environmental issues, but does not alleviate the problem at all but rather will likely amplify it.We cannot offer help to those who will not accept it, nor should we offer our compassion to those who refuse it. Enabling people to continue to make bad choices is antithetical to compassion. Yet that is the best that Mayor Anne and the council can offer.

A firm hand in keeping street camping out of our city is needed here and the money for this idiotic program should be diverted into drug and mental health programs for the homeless and more policing of homeless people that are sometimes a danger to the public. We should be offering help to street people who want to get off the street, and have the police remove illegal campsites with prejudice. Pumping potentially millions of dollars into a program that is more likely to perpetuate and expand the problem is foolish. All of this wasted money comes at the expense of tax paying citizens.

The wealthy class of elected leaders and their rich donors will not feel the pain of this program. No, the middle class and poor people in Vancouver will bear the burden of increased crime, vandalism, and lower property values. The every day citizen will suffer the most. That is just typical political crap once again dumped in our neighborhoods.

We can do better.

Top photo published by KATU, lower photo published by Clark County News Today

Friday, July 30, 2021

Are Californians Really Driving up Values?

I hear this notion a lot from sellers and buyers. Typically this comes from anecdotal evidence like a buyer says... "I got outbid by a cash buyer from California." California has been the big bad boogeyman in the Northwest for decades now. For many years California real estate prices outpaced growth in the NW leading to an opportunity for Californians to sell or borrow against, their high priced properties and pay cash for similar properties in the NW often outbidding or displacing locals trying to buy the more 'traditional' way using a bank loan.

Much of it was perceived rather than reality, but there was some truth to the notion. The rapid rise in real estate values came to us because the Northwest is desirable. The Californians came here much like mid-westerners went there in droves during the Golden state's post-war boom. In the 1950s and 60s there was ample opportunity in California's booming economy and the weather and scenery was a lot better than most of the USA.

As a consequence to the demand and government actions, during the 1970s California real estate became very expensive. The state began to enact very strict building requirements and regulations that drove the cost of new homes up and demand continued to outstrip supple well into the 1990s. Many in the 31st state started to become unhappy with the crowds, high taxes, traffic, and escalating cost of living. Oregon and Washington among others, were natural targets for the aggrieved in California.

But how much of our housing costs are really being driven by exterior forces such as people coming from California? Maybe not as much as you think. Both Oregon and Washington have emulated to some degree the California regulatory atmosphere. A large chunk of a new home's expenses is permits and government mandates, engineering and such. This was one of the primary drivers in California's rapid housing rise in the 1970s and 80s. Now that the NW economy has become much more diverse than just logging and maritime industries, we too are in hot demand. Our land prices are rising as are the regulatory costs to build.

Washington State isn't even in the top five destinations for Californians moving out any more and hasn't been for years. One reason could be the fact that Washington State is the 4th most expensive housing market in the US and California is the 2nd. Washington is no longer a "bargain." In fact according to statistics from the National Association of Realtors®, King County Washington is more expensive than 52 of California's 58 counties. Yes only San Francisco, Santa Clara, San Mateo, Marin, and Santa Cruz counties are more expensive than King County, WA. Three of those five counties lost value over the last 12 months! King County as with most of Washington State is still seeing increases. Most residents of the Golden State can't afford to move here anymore. Even our local Clark County is about the same as Sacramento, County, CA.

Top Ten Counties on West Coast by Median Home Price Q2 estimate :

- Santa Clara County, CA population 1,927,000 (San Jose, Silicon Valley) $1,150,000 +4.1%

- San Mateo County, CA population 767,000 (Silicon Valley) $1,100,000 -6.5%*

- San Francisco City and County, CA population 875,000 $1,000,000 -6.9%*

- Marin County, CA population 260,000 (SF Bay Area) $965,000 -7.9%*

- Santa Cruz County, CA population 274,000 (Monterey Bay) $875,000 +4%

- King County, WA population 2,302,000 (Seattle) $800,000 +6.4%

- Orange County, CA population 3,168,000 (Anaheim) $795,000 +5.7%

- Alameda County, CA population 1,657,000 (Oakland) $775,000 -4.2%*

- Napa County, CA population 140,000 (Napa Valley) $725,000 +4.8%

- Los Angeles County, CA population 10,081,000 (Los Angeles) $705,000 +6.6%

- Clark County, WA (Vancouver) $402,463

- Alpine County (High Sierra) $375,200

- Humboldt County (Eureka, North Coast) $366,400

- Stanislaus County (Modesto) $363,600

- Butte County (Sacramento Valley) $351,100

- Calaveras County (Sierra Foothills) $336,300

- Sutter County (Sacramento Valley) $333,200

- Amador County (Sierra Foothills) $330,200

- Mono County (Eastern Sierra, Mono Lake) $329,000

- Madera County (Central Valley) $318,400

- Yuba County (Sacramento Valley) $307,900

- Fresno County (Fresno, Central Valley) $306,400

- Tuolumne County (Yosemite) $304,500

- Trinity County (Siskiyou Mountains) $302,900

- Merced County (Central Valley) $300,700

- Shasta County (Redding, Shasta Lake) $297,700

- Mariposa County (Sierra Foothills) $290,200

- Inyo County (Eastern Desert, Death Valley) $283,300

- Colusa County (Sacramento Valley) $279,200

- Lake County (Clear Lake, Wine Country) $268,700

- Kings County (Central Valley) $265,200

- Tulare County (Central Valley) $260,300

- Tehama County (Sacramento Valley) $256,300

- Plumas County (Northern Sierra Foothills) $255,100

- Kern County (Bakersfield, Central Valley) $253,000

- Glenn County (Sacramento Valley) $245,500

- Imperial County (Desert South, Calexico) $244,300

- Sierra County (Sierra Foothills, High Sierra) $243,600

- Del Norte County (Crescent City, Redwood NP) $230,300

- Lassen County (Mt. Lassen NP) $213,700

- Siskiyou County (Mt Shasta, Siskiyou Mountains) $209,400

- Modoc County (Northeastern Corner) $148,000

The rising cost of housing is no longer about one "rich" group driving up values, but really our own state and local governments pushing of heavy and ever increasing regulatory requirements that drive up the cost to develop land and this is an AWESOME place to be and everyone wants to live here. This is what really drives the values up.

So Californians may be a pain in the rear quarters, and don't get our more relaxed Northwest vibe, but they are not really the cause of our bloated real estate prices. That won't stop us from blaming them though... they messed up the Golden State pretty bad, so bad they are fleeing by the tens of thousands every year. We just don't want them screwing up our great state. The real boogeyman if we are honest, is King County and Seattle. They are buying up more Clark County homes than Californians at this point.

Friday, July 23, 2021

Huge Surge in Listings, Boosts Inventory Levels

It seems the pandemic has subsided enough to bring out all those missing listings. The local MLS saw a massive surge in new listings over the last two weeks. This is good news for buyers as the tight inventory led nearly every transaction to a bitter bidding war with one lucky winner and half a dozen disappointed losers. Many buyers have become disenfranchised from the process after numerous failed attempts to land an accepted contract.

This buyers should come back as things have definitely cooled off a tad. The market still favors the seller, but buyers may find a little more options available and fewer offers on houses that are not top drawer. This plays right into the article I wrote last week about watering the lawn. Sellers need to keep the house and grounds looking sharp, because buyers have more to look at now that they have at anytime in the last half year or so.

I won't have to total stats until the MLS releases July's figures next month, but I am certain it will show a major surge in listings as preliminary data suggests. We needed this and it should tip the scales back a tad towards neutral offering buyers a little more opportunity to own their own home.

I listed a lovely three bed, two bath home last week for $435k and was shocked when the first two days had no showings. That's when I realized that a dozen new listings had come up at the same time within a mile of the property! Well by Monday showings picked up and the home was in contract by Wednesday. But this house had an advantage. It was dated but immaculate inside and out. The owner had that old girl shined up like new. Buyers in this day an age tend to favor move-in ready homes that do not require a lot of work. Our society today has become busy, houses have gotten so expensive that buyers often have to work long hours to afford them. So keep in mind that often the best looking house wins the day.

Friday, July 16, 2021

Even in this Tight Market, Water the Lawn!

With the market seeing a half dozen or more buyers for every listing, sellers may feel complacent and just let the front yard go this summer. Sure, you will sell the house and you may even get multiple offers, but you won't get top dollar if your house looks unkept.

No matter what the market conditions are, human nature doesn't change with real estate trends or whether buyers or sellers are favored. People have impressions that can be hard to overcome. The very first impression if the drive up to the house. A nice and tidy front yard and clean look is a positive start to the showing experience for the buyer. That should continue as much as possible. Ideally the first three impressions ought to be positive before the buyer starts looking closely. There are often going to be negatives for the buyer even if the house is emaculate because they may not like the layout or other fixed design elements. Having three positives before encountering any potential uncorrectable negatives sets the seller up for a better offer.

People are people and they tend to make decisions based on how they feel as much as the pure logic of the decision. Not every buyers agent is effective at mitigating the buyers emotional side of the decision making process or the logical side, and sometimes they are lousy at both. Setting up the buyers with mostly positive 'feelings' about the house will generate higher offers.

In short, sellers should still keep the yard up, keep the house clean and tidy, and show it often to ensure good market penetration.

Friday, July 9, 2021

Condos and Assessments can be quite the drag

Recently I noticed a large scale drop in listing activity and cancelations in a local condo tower. I decided to 'sniff' around and discovered that the building was originally plumbed with the dreaded Qest Polybutylene plumbing and a large scale assessment was likely for all the homeowners in order to get the building replumbed. This is a pretty large building and it looks like each homeowner is facing a sizable assessment from the HOA. Whenever I show a property my client seems interested in builtin the 1990s window, I check under the counters for that gray color pipe and fittings. If so my standard beware disclaimer is forthcoming.

The piping has a tendency to abruptly fail in rather catastrophic fashion usually leading to a burst pipe or fitting and lots of water going everywhere. It is a problem that can be remedied but at a cost. Selling units that are facing this situation is not as hard as people might think, and there are strategies depending on the sellers financial disposition to make the process seamless. But for buyers looking at properties be it condos or houses, checking for polybutylene pipes is important, because it is not a matter of if, it is a matter of when the flooding will happen.

There could be opportunity for a "deal" if there really is such a thing right now, in this building because a certain percentage of buyers will simply run away from these because of the perceived problem associated with the assessment and the timeframe for remedy.

Sometimes a bad thing can be a good thing.

Friday, July 2, 2021

Market Remains Tight but Not Hot, There is a difference.

Our market seems like it is hotter than Monday's all time record afternoon high temp, but digging into the numbers reveals our seller's market is only tenuous at best. Multiple listing service stats show Clark County over the last three months has only had about 150-200 transactions per month which is well under the 400-600 we are accustomed to seeing in the springtime. The culprit isn't a lack of demand but rather a lack of inventory. It looks like the pandemic left a chink in the armor of the real estate market. It seems few people want to sell their home.

I get it, Clark County is a great place to live and this area routinely finds its way onto best place to live type articles in various national magazines. But sellers seem to be worried about their ability to buy another house when they get their current home in contract. That is a fair consideration but it is exasperating our dilemma with inventory. Sellers are in control of the market, they can easily dictate terms of sale to buyers including longer escrow periods and rent back after close clauses to allow them time to acquire a replacement home.

Personally I had by best year ever in closed volume in 2020 and one of my best in total units closed and this year I have been off to a rather sluggish start. Largely due to a lack of listings. Many of my clients that are in that 'sweet spot' 5-8 years since they bought their last home are not interested in selling. Everyone seems to be content, whether truly so or worried about an uncertain economic future, they are choosing to stay put.

The listings I am getting this year are almost exclusively people that are leaving the area to either retire or for an employment change. The "move up" market seems almost dead. Prior to the COVID 19 pandemic new home builders were making a killing by providing inventory to a very hungry market, but alas, they have run into high cost of materials and a flat out lack of materials to keep pace.

The bottom line is that this sizzling hot market is at least a bit of a mirage as it is completely supply side driven. The number of buyers is shrinking due to affordability, but the number of homes for sale is also shrinking and or flat. Prior to COVID we had a robust almost neutral market slightly favoring sellers and now we have a much smaller market with tight inventory and a bidding war on nearly every home that comes to market in the price ranges from $300k-$900k.

Hopefully the materials shortage will ease up and allow home builders a chance to continue providing new home inventory. That could be the trigger mechanism for would be sellers as they would not have the concern of finding a replacement home when they sell their current home.

Friday, June 25, 2021

Listings Still Rare, But Inventory is Softening

Well, softening a little bit. Listing count is up and that is a good thing, but in most price ranges and market segments, buyers outnumber sellers in fair numbers. Buyers still need to bring their "A" game with offers lest they be outbid. Buyers need to understand that a house that is really nice and move in ready, modern design, etc will likely get bid up. Homes that are older or maybe a little bit of disrepair are less likely to be bid up.

As new construction ramps up with materials finally starting to retreat back on price and availability this will offer buyers options to resale homes that have been in tight supply of late. I see a soft landing in real estate over the next couple of years. As interest rates rise, which they likely will, due to aggressive spikes in inflation, real estate demand will see a slowing decline and begin to match the inventory.

Some people fear the "bubble" and that is a real thing, but to burst the bubble we would need to see a major rise in listings and I don't see that happening.

Buyers should feel secure in the decision to purchase a home, and skeptical potential sellers should see more opportunity on the buying side over the next few months which may make them feel comfortable listing their home.

Here's to a nice couple of years with modest increases in housing prices and a slow and low rate of interest rate rise.

Friday, June 18, 2021

Better Late, Than Never

Well the spring rush of listings was rather late this year, but inventory seems to be showing up at a more typical spring pace now that were are almost at summer. I'm seeing a serious bump in available inventory. Now to be clear we are still tight and sellers still hold the better hand. But with building materials coming down off the crazy pandemic high cost and people starting to relax a but on Corona-Fear, things are looking a little more promising for buyers, yet still good for sellers.

Interest rates remain fairly steady and still low so buyers should be able to still the proverbial light at the end of the tunnel. My son is getting married this weekend and things are hectic around the house, so that's all I got this go round!

Friday, June 11, 2021

Could Midtown Vancouver be the Next Hot Location?

There is currently and has been for about 5 years now significant development in the area. Two sizable urban apartment projects went in a few years back with hundreds of units, 13 West on West 13th and Columbia and the large 15 west project on West 15th Street. Just north of 15 West, Ginn is building a infill urban apartment building. At C Street and Mill Plain the entire block is now Al Angelo's mid rise mixed use building. New Seasons market is going in at 15th and Main and that should create a buzz in the area as a market is the only thing missing in the greater

Downtown area. The block just west of the New Seasons was purchased recently by an investor group intending to erect a mid-rise building that will cover the entire block. Some high end units in two mid-rise towers recently came to market, Our Heroes Place at Mill Plain and D Street. This corridor is seeing some serious action and that new market might just bring some condos or other high density residential to the area.

There is currently hundreds of millions of dollars in construction projects in the downtown area and more than a billion in proposed projects waiting in the wings. But the waterfront and lower Downtown areas are fairly expensive and the Mid-town area has a chance to provide some solid affordable urban high density housing with good access to amenities and the freeway for commuters. I'd keep an eye on this area it could be the next new thing.

Friday, June 4, 2021

State to Fully Open: Good for Inventory?

Part of me feels like the ultra tight inventory is at least partly due to a 'fear' of COVID and the decision by Governor Inslee to reopen the state this month may lead to some relaxation of anxiety that some sellers may have about strangers walking through their house during the listing period. But further exasperating the problem is a serious lack of building materials that is slowing the new construction slowdown and creating rising prices for new homes. This puts additional pressure on resale homes. Any seller thinking about making a move, right now the stars are aligned for sellers to dictate their terms.

Many sellers are concerned about "where will I go?" With inventory tight sellers can make rent back arrangements or other arrangements to soften the pressure about finding the replacement home. Once the building materials crisis ends, new homes will once again compete with resale and the window may close a bit on sellers.

So far this spring listings have been slow to materialize but they are picking up and I hope the reopening will bring out the remaining sellers that might be waiting for the pandemic to wane.

Interest rates remain competitive and buyers can still get a fair bit of house for the money available to a median income family in Clark County.

Friday, May 28, 2021

Vancouver Neighborhoods All Over the Board

Neighborhoods do matter. People will pay a premium to live in a neighborhood that offers something extra over another. Better schools, closer to services and shopping, views, access to highways or closer to major employment centers, and so on. Vancouver is a large enough city that it has a full range of neighborhoods across every urban and suburban subset. Just out side of town Vancouver even has some semi-rural neighborhoods with homes on small acreage.

But neighborhoods are hard to measure without a local real estate pro. Simply looking at a map or stat sheet with median prices will not tell the tale. Sometimes a better neighborhood has a lower median price. For example a neighborhood like Fairway Village in Vancouver has a lower median price than Felida. But pound for pound or foot for foot, Fairway Village is spendier. You see, Fairway village is a subset of Cascade Park East and it is entirely comprised of homes aimed at retirees and most are two bed units. These are smaller homes and thus tend to be a bit less expensive than the much larger homes typically found in Felida.

Often times the median price of a neighborhood is driven by the fact that the area is confirming with lots of similar houses either big ones or smaller ones and thus one is lower than the other. Other times one neighborhood may have very similar styles of homes yet be priced very different, here is where the classic "location" issue arises. One mind find that lower priced areas are not always undesirable. The Esther Short neighborhood is one of the hottest neighborhoods in the city, yet the median price in that neighborhood is well below the citywide median at only $350k. What gives? Esther Short is downtown and the waterfront. The bulk of the homes in the area are mid-rise and high-rise condos or apartments with an average size of less than 1000 square feet. So the median price per square foot is really high at more than $350 per foot. Contrast that with the expensive Riverview area the most expensive area at a median price over $1,000,000 but an average home is around 3000 sf. That neighborhood averages about 300 per foot. I wrote about price per foot and how it is rarely a good indicator of real value, but it shows that median pricing alone is only part of the neighborhood equation.

Below is a map of Vancouver with pricing as of last month for broad neighborhood areas in and around the city. The overall median price for Vancouver was $423,000 at that point.

Friday, May 21, 2021

Despite Craziness in Market, Buyers Won't Bite on Overpriced Listings

The title says it all. Buyers are getting desperate in the market as any home that is priced near its market value is quickly inundated with offers often well above asking. Yet a home priced 5% over received market value sits for weeks without offers. This is a bit of an unusual situation as the bidding war often leads to a final price several points over ask anyhow. Buyers seeking to avoid the crazy auction style offer scenario should look at houses they "feel" are overpriced as these could be an opportunity to avoid giving up inspections and all of that in favor of a traditional negotiation with the seller. Maybe offer a little less than asking. Buyers should embrace homes that are priced a tad higher as they may end up with a better deal without the hassle of losing five or six deals being outbid before finally paying too much in a bidding war.

A good buyer's agent can guide buyers through the process of evaluating value and suggesting offers that have a good chance of success. Buyers should not be afraid of writing an under ask offer on a home that is overpriced. Writing such an offer on a property that is priced well is a fool's errand. Too many buyers are giving up vital protections such as the important inspection contingency to strengthen their offer against a half dozen others and if they simply look at a home that is a bit overpriced, they have a stronger negotiation position with the seller and will not have to give up important protections.

Buyers should embrace slightly overpriced listings as an opportunity to avoid the crazy auction style offer systems and remember that if a buyer is using a loan product the bank will not allow them to overpay for the house. The purpose of the appraisal in a transaction using a mortgage loan is in fact to protect the bank's position. It also in effect protects the buyer from overpaying for a property.

Buyers can navigate this challenging market under the good service and advice of a local expert agent.

Friday, May 14, 2021

Spring Listings are Here, but not in Typical Numbers

That classic spring perk in listings has definitely happened, I am noticing more and more new listings showing up on the MLS. However there does not seem to be that heavy load of inventory that traditionally hits the market when the sun starts shine each spring.

Spring is also when many buyers come to market and they may be disappointed to find little options. That said, I feel like the spring rush of buyers is also a tad lackluster and that could be a blessing in disguise. Buyers have had a hard go of it over the last year, a little less competition might help those frustrated with the situation to finally get their home.

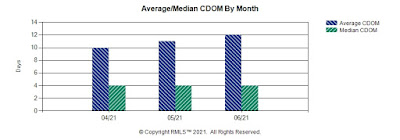

This is not to suggest that things are not tight, they are as tight as I have ever seen it. According to the data we are measuring inventory not in months or even weeks but DAYS! 12 days of inventory for the classic 3 bed 2 bath home in Clark County. Yikes! I ran a report on the local MLS showing the last three months of homes that are classic starter homes. Three bedrooms, two bathrooms with 1200 to 1700 SF. All across the county. Take a look at the results:

You may notice that the gap between new listings and sales did widen just a bit suggesting that a little extra inventory is now available. Maybe we can start using weeks agin to describe inventory in the next month or so. The second chart shows that the average list price is a tick higher than the average sold price. That shows market pressure is high. Remember most closed sales are 30 to 45 days behind the current market. A classic starter home in Clark County will set the buyer back about $400,000 that's just where we are right now. It is hard to see but the closed price is a tad higher than the list price showing that market pressure is getting sellers more than asking in general.Friday, May 7, 2021

May is here, will the listings arrive with it?

The ultra tight inventory locally remains an issue for battle weary buyers. May is traditionally a month that see a boost in listings so let's hope that holds true in 2021. Buyers should continue their quest for the elusive home. But buyers should also be sure to look at home priced at least 3-5% lower than their maximum affordable price. With multiple offers the norm, buyers will have to bid properties up a bit to get their offer to the front of the sellers list. A buyer approved for a $400,000 house will need to consider shopping in the $380,000 to $390,000 price range so they have wiggle room in multiple offer scenarios. That strategy will help speed up the chance of landing a house, but it is no guarantee.

I have a few listings coming up this month so if that is true among my colleagues as well, then perhaps a wee bit of relief is on the way for beleagured buyers. Sellers in the mean time are comfortably perched in the proverbial 'catbird' seat. Sellers should also be mindful of trends in listing activity. If things begin to perk up for buyers the window for that top dollar opportunity may tighten.

Stay on top the news and don't get too greedy, the market can be fickle and the crazy state of world affairs means things could change direction at a moments notice. What is relief for buyers could be misfortune for sellers. Happy hunting.

Friday, April 30, 2021

Spring Listing Bump is Coming... How Big is the Bump?

I am seeing the traditional listing bump that often comes around every spring. Not just my business or our office, but across the board. Our market is a bit desperate for new listings, so buyers might be able to catch a breath. Springtime tends to bring out buyers however as well, so the question is what the title suggests... How big is the bump?

The COVID 19 pandemic has definitely shaped the current market. I had a record year in 2020 for volume, so I can't say I saw a slowdown in local real estate. The Regional Multiple Listing Service has reported that sales have been robust. But COVID 19 has altered some of the patterns in real estate as well as created in my opinion, a smaller number of fresh new listings. It. may be that some people simply don't want to invite people into their homes during the pandemic out of perhaps safety concerns regarding the virus. This seems reasonable, but at this point possibly more emotional than logical.

With the vaccines now widely available and many governments pulling back on the lockdowns, some of that concern may be starting to wane. I believe that demand will continue to outstrip supply for the next several months, but this market has given us inventory levels measured not in months, nor even weeks, but DAYS! I have been in real estate for more than twenty years, I can't remember ever having an inventory tighter than two weeks, but that just happened!

I think some of that inventory pressure will lighten but we should remain firmly planted in a seller's market through the summer months. Sellers that make their home available will do better than sellers that limit exposure. This is a general rule even in a seller's market.

I have two new listings this month and I do not expect either to last long at all. This is a great time to sell your home, seller's are firmly at an advantage.

Friday, April 23, 2021

What makes a neighborhood "good?"

- Location: This is mostly fixed and based on proximity to transportation, shopping, schools, etc.

- Crime: this is a fluid feature based on how much criminal activity is occurring in a neighborhood, this can ebb and flow with normal neighborhood transitions through the various cycle of real estate as well as local government policy.

- Uniformity: This is semi-fixed based on the building and zoning type. Going from an eclectic mix to a uniform neighborhood takes years or decades. But having a consistent neighborhood with similar styles and values is generally a positive neighborhood feature.

- Public spaces: Parks and natural public areas tend to enhance the value of a neighborhood

- Infrastructure: Quality public infrastructure and improvements tends to increase the value of a neighborhood.

- Ownership: The percentage of rental units to owner occupied units affects value in neighborhoods. Generally more owners increases value, unless the rental units are extremely well managed. An HOA controlled neighborhood tends to keep rentals well managed.

- Relative proximity value: Neighborhoods with lower priced homes than those immediately surrounding it, tend to have the values pushed slightly upward on the 'coat tails' of the nearby more expensive properties. Likewise expensive homes surround by more modest homes tend to be dragged down a bit. This is a fixed condition.

- Noise: This is typically fixed and is of particular importance in suburban and rural neighborhoods. The expectation in urban areas like Downtown, is that noise levels will be high so it is a little less of an issue in high density areas.

- Traffic: This is semi-fluid. It is tied to infrastructure and location. It can be improved with infrastructure but can get worse with growth of population or additional development that over extends the existing infrastructure.

- Prestige: Some people want to live in a neighborhood that is prestigious. Usually prestige comes at a very high price. Sometimes however middle-income neighborhoods are also prestigious in that they just happen to be really nice areas of modest homes. That ties into location nd infrastructure. Generally a prestigious neighborhood leads to overpriced homes and are not necessarily better places to live than other similar neighborhoods. Use caution when getting caught up in prestige, it can be a good thing, but not always the best thing.

- Natural Disasters: Some areas are prone to flooding, fires, landslides, etc. Clark County Washington doesn't have a lot of issues with proximity base natural disasters. But buyers should consider the possible dangers of certain locations. Things like earthquakes and tornadoes are going to strike random areas and that is too unpredictable to worry about. Weather and seismic issues are also more of a construction issue, how well made is the house rather than neighborhood location.