This market is one I can't remember seeing before. There has literally been a slowdown in sales to about 50% of what they were just two years ago. Generally when the real estate market sees a slowdown that severe it results in a substantial correction in pricing. But that has not happened here. Why not?

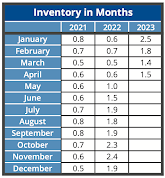

Well I have touched on this before but it serves well to bring it up again. When rates rose from the low 5's to the mid 7's in the short span of a few weeks in the summer of 2021, we lost about half of all the buyers that were looking. Normally when demand drops in half prices follow. But this time was different because sellers were not selling either.

We have a strong job market here in the Portland-Vancouver metro area and people are coming here in higher numbers than are leaving. Sellers have been staying put because they are sitting on a historically low interest rate and either can't financially afford to move or simply do not want to move. So just as the demand fell to half, so did the supply.

What is left is the same 2000 agents selling half as many houses every month. So you will no doubt hear agents whining about how slow the market is, but in reality it is about the same as it was in late 2021. Prices have been mostly flat and things are just treading water, so to say.

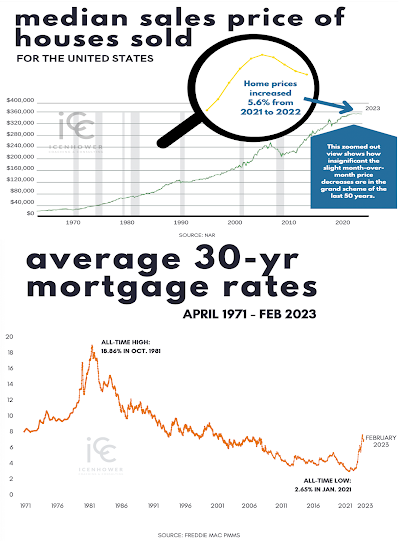

You may see allot of these price reductions happening, but they are mostly from overzealous sellers that have their property overpriced and eventually realize that the market won't support the puffed up vision of their home value. I believe that this unusual dynamic is the only reason we have not seen a major price correction. I fear that the Fed wants a major price correction and will continue to raise rates until they get it.

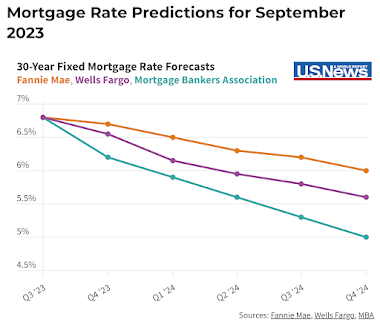

The Fed is either not run by the smartest people or they are run by people with an agenda that is unfavorable to the middle class. That is brilliantly evident. But they do hold an enormous amount of monetary power. If their intent was to slow the economy on soften housing, they would have got their wish had they raised rates more slowly. Sellers would trade a 2.9% mortgage to buy a new house they like better at 3.5% but asking them to move from 2.9% to 6% or 7% is a tough ask. Baby Boomers and older Gen Xers are in the downsize mode but many of them can't justify exiting a sweet 2.9% rate to buy a smaller less expensive house and pay MORE on the mortgage payment. That doesn't make sense at all. So much of our transactions right now are either cash or super large down deals where the interest rate isn't really that much of a factor.

Let me cite an example. Ms. X bought a 2500 SF 5 bed house in 2002, she refinanced it in 2018 at 2.9% and paid off a home equity line in the process. So now she has a $310,000 loan on a home that was worth $500,000 at the time. Her payment is only $1750 PITI. Fast forward to the fall of 2023. She would like to downsize as she is a classic empty nester and would like to eliminate the stairs in the home. The house is now worth about $625,000 and she owes a little less than $300,000.

Well she has a large equity position but she can't buy a comparable quality 1500 SF ranch for much less than $500,000. So she needs to put down $275,000 on a $500,000 purchase and has to borrow $225,000 at 7.5% to make the deal go. Her new PITI mortgage payment is $2100. Unless she is physically unable to use the stairs, it is unwise to make this move. Frankly installing a stairlift for $2000-$3000 makes more sense if she has trouble with stairs.

This is the state of the market right now. I must admit, my personal situation looks similar contextually to Ms. X situation. Why give up a nice large home for a smaller one at a higher monthly payment. Hey how about you trade your 2017 Cadillac in on a 2017 Chevy and pay us more 20% more money for it? Uh, no thank you.

Now one solution would be to rent the current house out. Ms. X is paying $1750 for a house she can rent for $3500 a month. That will provide some cash flow that is enough to more than make up the difference in payment on the downsized home, right? Of course now she is looking at a more modest down payment of 3.5% for an FHA loan on a $500,000 house. This payment is going to clock in at around $4000 a month minus the $1750 cash flow from the rental. Wait a minute... That's worse!

The Fed is NOT doing middle class America any favors here. It sure seems like they are in bed with the hyper wealthy and everything they are doing is specifically tailored to make the billionaire class richer. Keep that in mind when you vote each election. The rich and the ruling class have never liked it when the peasants own property :)

.jpg)