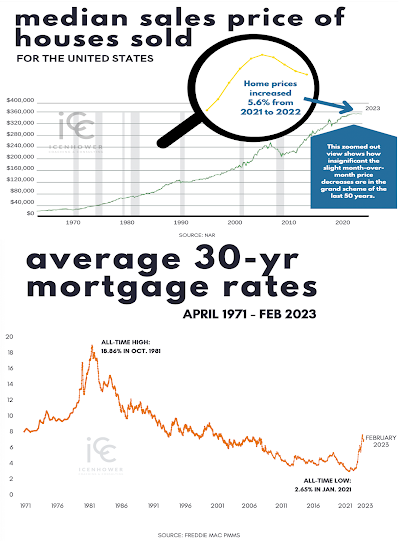

The news media, the doomsayers, and other miscellaneous talking heads have declared the real estate market as terminally ill with rising interest rates. Hmm, all because rates are now at the 50 year average. Not above average, not the soaring double digit nightmare that was the late 1970s and early 1980s. No we're are 'plagued' with average interest rates. I'm sorry friends, 7% mortgage rates will not tank a real estate market. This slight slowdown in units sold is a typical adjustment period after coming off a long period of low rates, in fact the lowest mortgage rates in the history of 30 year loans.

When you look at the historical housing market you see it has had a few bumps in the road over a 50 year history of going up, up, and up. You juxtapose that with the 50 year mortgage rates chart which shifts position more than a politician in a purple state. You see that this "crisis" is completely manufactured. The media and notably other organizations that have something to gain from negative news about real estate, may be behind it.

The real estate market is only temporarily slowed by changes in the interest rates. The demand for housing never goes away, increasing rates can make it difficult for some buyers and that can slow things down for a short while, but banks will always find a way to make loans, and people will always find a way to buy homes. Historically we have only had two major downturns in the last 100 years and they were 1929-1941 and 2008-2012. Every other "downturn" has been short lived and in the grand scheme of things, insignificant.

Is it a good time to buy or sell real estate. Yes friends it is a good time. Real estate has always been and will likely always be an excellent long term investment. There is no 'day trading' real estate. The transactions are slow and expensive. It is a long term investment. Buyers and sellers need to stop thinking short term. If you plan on living in a house for less than 2 years, generally it's better to rent or buy a house and rent it out when you need to leave. Even during the Great Depression of 1929-1941 real estate was a good long term investment. Why do I say that when prices were declining or flat through most of that period? Because the home still provides you with its essential function of shelter for you and your family.

In my 2010 book, "Don't Panic" I have an entire chapter dedicated to dispelling the notion that your primary residence is an investment property. If it is an investment property you should be renting out any extra rooms you have to maximize that investment and increase your rate of return. But most people don't. Why not? Because it is their home, safe haven, shelter from the elements, a basic human need. That's why. Owning that shelter is better than renting it from a third party in 99% of life's scenarios.

As for the market, locally we are sitting on a 2 month supply of houses. With 4-6 months being average, we are in fact still hot. Yeah, it's a good time friends.

No comments:

Post a Comment