The local MLS, Regional Multiple Listing Service has improved their reporting this year with an excellent display of data. I have been mentioning for quite some time that our market is red hot in the 110% of median and lower, and has cooled off considerably in the upper price ranges. There are some notable exceptions with Downtown Vancouver high end condos which seem to be doing just fine.

Year over year the median price is down 2.9% but based on the full set of data the MLS provides, the upper end market is lacking sales and thus the median is coming down. Remember that the median is simply the "middle" so when fewer expensive homes are sold the middle becomes a lower number. The actual asking price of a standard 3 bed 2 bath house is about the same as it was last year but this year the house is getting 1-2 offers whereas last year it was getting 3-6 offers and way over asking. That is also leading to the median drop.This data does not suggest the market is dropping as much as it suggests its rate of growth is slowing. There is a difference and it matters. People become nervous about buying a home if they think its value is a bout to drop. So far indicators support mild real estate appreciation over the next 12 months. Of course anything can happen in the economic cycle and projections are just that. But there is no alarm bells going off here. The slowdown is two-fold: first the abrupt rise in interest rates eliminated at least half of the buyers in the local market. Under different circumstances that would have crashed our local market. But the market was so tight on inventory that it just took some needed pressure off and it was actually a healthy adjustment. The second factor which is keeping inventory lower than it would normally be is that fact the homeowners are reluctant to give up their low interest loan to buy another home elsewhere. Many homeowners that might be ready to move up to a bigger home, or a place with some land, etc, are sitting on a 30 year note with 25 to go at 3% sometimes less. The move up will put them in a new loan at 6.5% or more. This is stifling inventory. Unfortunately the government acted too quickly and created a scenario where rates rose almost instantly rather than a gradual rise over the course of several months. A gradual rise would have been a much smoother transition from hot market to normal market. The quick rise basically slammed on the brakes.

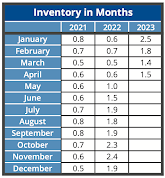

So when looking at the data you see that sales are down, but new listings are down about the same amount, marketing time is up a little and median price is down slightly. With just 1.5 months of inventory this is still a sellers market and we won't see a neutral market until inventory gets up around 3-5 months. Once the inventory moves to six months or longer the market transitions to a buyers market.It's easy for doomsayers to persist with sales numbers so much lower than last year but the real truth is that the only people really feeling a big difference in the market this year over last year are the people at the very entry level from last year who no longer qualify and real estate agents who are all fighting for a slice of a shrinking pie. Some agents may sing the songs of doom, but the market is actually still doing well despite the governments best efforts to crash it.

Looking forward to Q3 I'd say the chances of an increase in buyers is slim, but the chances of increased listings is 50/50. An increase in listings with no change in buyers will soften the Markey up a bit and make things a little easier on buyers without too much downward price pressure. Buyers should keep in mind that interest rates are not high right now they are average, we just came off a 10 year period with below average rates. It may feel like they are high but we are finally back to "normal" and I believe the nation will adjust to mortgage rates in the 6s.

No comments:

Post a Comment